Property shares let you buy part of a home and pay rent on the rest. It's a path to homeownership for those who can't afford a full mortgage. Learn how it works, who qualifies, and how to climb toward full ownership.

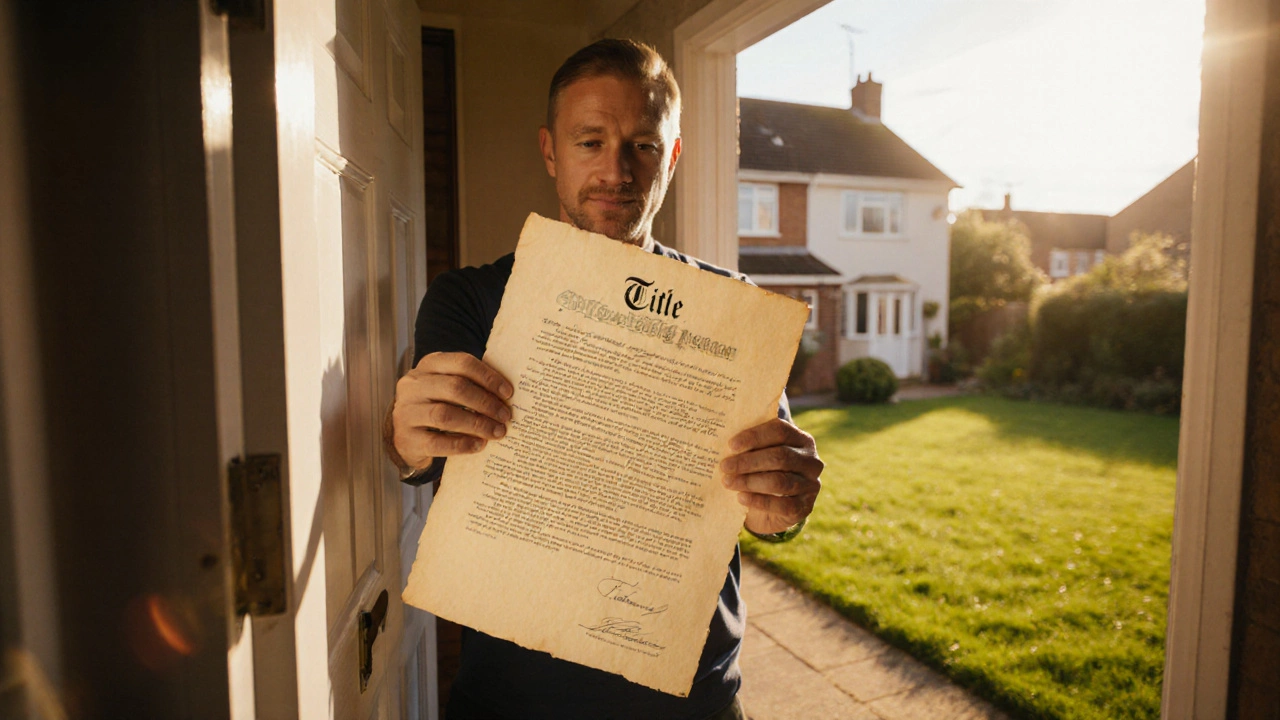

Shared Ownership: A Practical Guide for First‑Time Buyers

If you’ve been scrolling through property listings and feel a wall of prices stopping you, shared ownership might be the shortcut you need. It’s a scheme that lets you own a slice of a home while paying rent on the rest. In plain English, you buy, say, 25% of a house and rent the other 75% from a housing association. This blend of ownership and renting cuts the deposit you need and makes mortgage payments more manageable.

What is Shared Ownership?

Shared ownership is offered by many UK housing associations and some private developers. The key idea is simple: you purchase a share of a property—usually between 10% and 75%—and lease the remaining share. The rent you pay on the lease‑hold portion is often lower than market rent because the housing association benefits from a steady tenant.

The scheme works best for people who can’t afford a full mortgage now but expect their finances to improve later. When your circumstances change, you can usually buy more shares (called ‘staircasing’) until you own 100% of the home. At that point, the rent disappears and you become the sole owner.

How to Calculate Your Share

Start by figuring out the total market value of the property. If the house is listed at £200,000 and you aim to buy a 30% share, your purchase price is £60,000. Add the usual 5%‑10% deposit to that figure—so you’ll need around £6,000‑£12,000 upfront.

Next, estimate the monthly rent on the remaining 70% share. Housing associations often charge around 2.5%‑3% of the unsold value per year. In our example, 70% of £200,000 is £140,000. At 3% annual rent, you’d pay £4,200 a year, or about £350 a month.

Combine the mortgage payment on your £60,000 share with the £350 rent, and you get a total monthly housing cost. Compare that number against what you’d pay for a full‑mortgage on the whole £200,000. Most buyers find the shared‑ownership route cheaper, especially early on.

When you’re ready to staircase, the price of the extra share is based on the current market value, not the original price you paid. This means you might need a larger deposit later, but the equity you’ve built up can help cover part of it.

To keep the process smooth, work with a mortgage adviser who knows shared ownership. They can match you with lenders that specialise in these loans and help you avoid hidden fees.

In short, shared ownership lets you get a foot on the property ladder without the huge cash outlay of a traditional purchase. By understanding how the share price and rent work together, you can plan a clear path to full ownership when the time is right.

In shared ownership homes, owners pay rent on the portion they don't own and gradually buy more shares over time. Housing associations earn income through rent and staircasing payments, not profit. This system helps people become homeowners without full upfront costs.

Timeshares aren’t dead, but they’ve changed. In 2025, few buy them for the old reasons. Flexible vacation clubs and short-term rentals have taken over. Here’s who still uses them-and why most people should avoid them.

Learn if and how owner’s draws from shared‑ownership homes are taxed in New Zealand, what deductions you can claim, and step‑by‑step reporting tips.

Explore what 100% ownership means, how it differs from shared ownership, legal forms, financial impacts, and step‑by‑step guidance for buying a home outright.

Learn how home shares work, from buying a share and paying rent to staircasing and eligibility, with clear steps and real‑world examples.

Learn what a share of ownership means, how shared‑ownership schemes work, staircasing options, costs, and key pros for first‑time buyers.

Unpack the hidden risks of ESOPs in 2025, from financial uncertainty to lack of diversification. Make sense of employee share plans before making decisions.

Ever wondered if you can sell shares of your house instead of the whole thing? Discover how shared ownership, shared equity, and selling home shares work in real life.

Wondering what happens to your jointly owned shares if one owner passes away? This article walks you through practical steps, the legal basics, and real-life tips for shared ownership properties. Don't miss the details about different types of joint ownership and how they affect your rights. Find out how the process actually works for families and co-owners. Armed with this advice, you'll feel more confident handling shared home ownership.

Ever wondered if being a shareholder in a shared ownership home means you get paid every month? This article unpacks how payments actually work, what 'shareholder' really means in this context, and the difference between shares and rental payments. Get practical tips on what to expect financially and helpful facts that clear up common misunderstandings. Find out why money doesn't hit your account the way you might expect.

Curious about making money every day without a full-time job? Shared ownership homes might be your ticket. This article breaks down how shared ownership can generate daily income, the nitty-gritty details of how it works, and what real people can expect from this investment. You'll get real-life tips, the facts behind those tempting earnings, and advice on picking the right properties. It's a guide for anyone who wants steady cash flow with less hassle than traditional real estate.