Jointly owned homes sound simple, but things get tricky fast when one owner dies. If you’re living in a shared ownership home, the way you own your share decides everything. Miss one small detail, and the share might end up with someone you never expected.

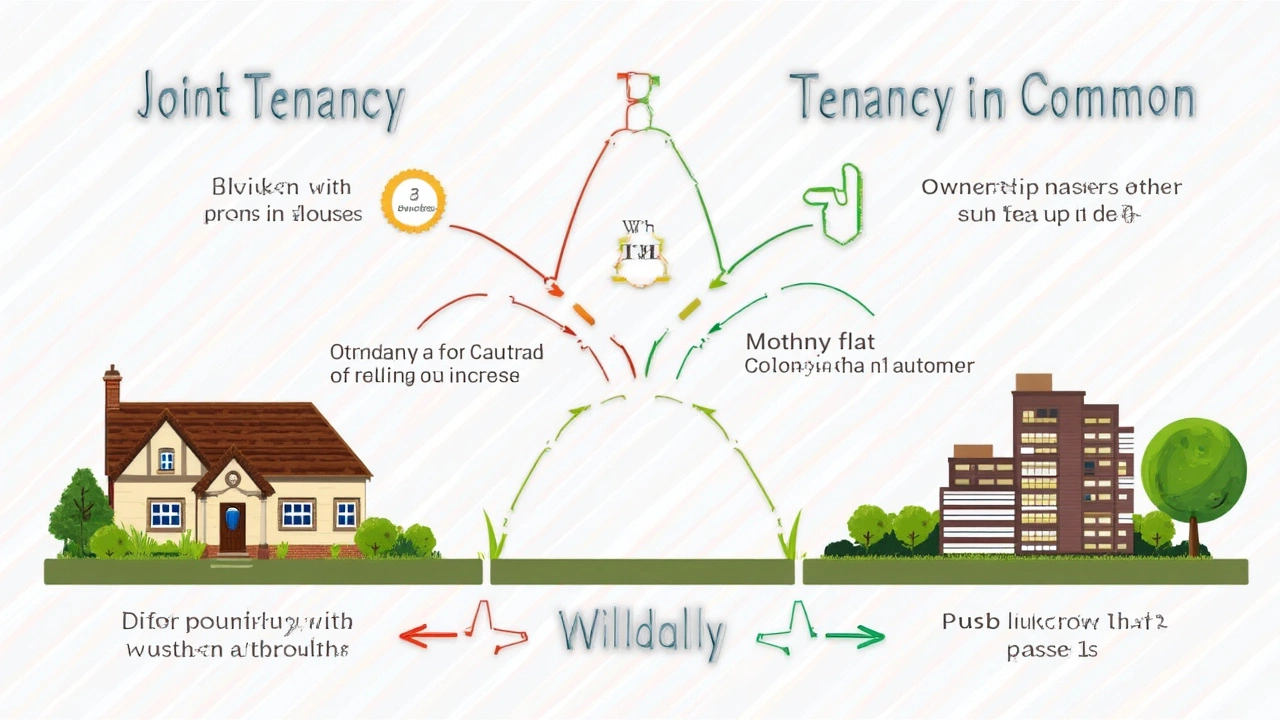

Here’s the bottom line: Joint ownership usually falls into two types—joint tenancy or tenants in common. That difference changes what happens next, from who gets the property share to how smooth (or messy) the process feels. Forget stuffy legal talk for a second. If you don’t know which setup you’re in, you’re not alone. Most people just sign the forms and hope for the best. But here’s the thing—knowing your type of joint ownership can literally decide if your family stays in the home, or someone has to move out.

If a co-owner dies, the rules kick in right away. With joint tenancy, the share slips to the surviving owner automatically. No will, no probate—just instant transfer. Tenants in common is a different ballgame. The share goes through the will or intestacy rules, which could mean a chunk of your home goes to someone else’s kids, siblings, or even an estranged uncle.

- Types of Joint Ownership in Shared Homes

- What Happens Legally When an Owner Dies?

- Step-by-Step Actions for Survivors

- Tips to Protect Your Share and Family

Types of Joint Ownership in Shared Homes

If you live in a shared ownership property, you and the other owner need to know exactly how you own it. That’s where the real difference between joint tenancy and tenants in common comes in. This isn’t just about paperwork—what you pick now can change who owns your home if one of you passes away.

Let’s break it down:

- Jointly owned shares as “joint tenants” mean you both own the whole property together, not separate chunks. If one dies, the survivor automatically gets the full share. No need for a will or court stuff. It just happens. Most couples choose this when they want the surviving partner to stay put.

- With “tenants in common”, you each own a specific percentage—like 50/50, 70/30, or whatever you agreed. If you die, your share goes into your estate, which means it follows your will (or intestacy laws if you didn’t make a will). This is common for friends or family groups, or people who want to leave their part to kids from a previous marriage.

Even if you don’t remember what you picked, you can check your property ownership documents or ask the housing association. According to data from the UK Land Registry (2024), about 62% of shared ownership leases are set up as tenants in common.

| Ownership Type | Survivor Gets Deceased’s Share? | Needs a Will? | Percentage Owned |

|---|---|---|---|

| Joint Tenancy | Yes, automatically | No | Not divided |

| Tenants in Common | No, goes to estate | Yes, if you want control | Can be unequal |

The bottom line? If you want your share to go to your co-owner, joint tenancy makes sense. If you want more say or your own family to inherit, tenants in common is the safer bet. These choices don’t just affect the future—they can make the difference between smooth sailing or a whole lot of stress for everyone left behind.

What Happens Legally When an Owner Dies?

Here’s where things get real for jointly owned shares. The law figures out who gets what based on how the names are set up on the property paperwork. That one detail decides if it’s a breeze or a nightmare for the folks still living there.

If you’re joint tenants, the rule is called ‘right of survivorship.’ What does that mean? In plain English: if one owner passes away, their share moves straight to the surviving owner or owners. No waiting for probate. You won’t see this share pass down through someone’s will—it never even gets the chance. Around two-thirds of UK shared ownership homes are owned this way, so this is the common path.

Tenants in common is a whole different animal. Each owner has a set percentage of the property, and they can leave their share to anyone in their will. If there’s no will, inheritance laws pick who gets it. This often means the share goes to a partner, child, or next of kin. It also means the survivor has to work with the inheritors—sometimes that’s great, sometimes it’s awkward.

| Ownership Type | What Happens on Death? | Probate Needed? |

|---|---|---|

| Joint Tenants | Share goes straight to surviving owners | No |

| Tenants in Common | Share passes by will or by law | Yes |

Here’s a tip: If you’re not sure which you are, look at your Land Registry documents or ask your solicitor. Don’t just guess. Mistakes here can upset families for years.

When probate is needed, be ready for slower access to the shared home, and sometimes, more paperwork than anyone really wants. It’s common for the whole thing to take anywhere from a couple of months to a year, especially in England and Wales. Stuff like outstanding mortgages or loans might also need settling before the share transfers to the new owner. If you catch this early, you can dodge a lot of stress down the line.

If the survivor can’t afford the rest of the home or there are multiple heirs, selling the property sometimes becomes the only option. Good to talk this through with everyone involved before it’s a crisis.

Step-by-Step Actions for Survivors

When a co-owner passes away, it can feel overwhelming to know what to do next—especially when you’re still processing what just happened. Here’s a simple, no-nonsense list to help you sort things out if you’re left in the shared home.

- Find out the type of ownership. Dig up your title deeds or Land Registry documents. Look for “joint tenants” or “tenants in common.” This one detail shapes every step that follows.

- If you’re joint tenants, it’s pretty straightforward. Send the death certificate to the Land Registry to get the name of the deceased removed from the property title. There’s a form called ‘Deceased Joint Proprietor’ (DJP). Fill it out. No will or probate needed to keep living there—it passes to you automatically.

- If it says tenants in common, things change. The share owned by the person who died doesn’t pass straight to you—it follows their will. If they had a will, the named beneficiaries inherit their part. If there wasn’t a will, laws of intestacy apply. Probate may be needed before anyone can do anything with their share.

- Contact your housing association or lender. Let them know what’s happened. If there’s a mortgage involved, speak with the bank too. Sometimes there’s mortgage life insurance that could cover the rest of the loan—it’s worth checking.

- Pay attention to bills, council tax, and service charges. These need to be paid so you don’t fall behind during the process. If money is tight, let your providers know; you might be able to get some leeway.

If you’re dealing with jointly owned shares and you’re not sure what comes next, get some advice from a solicitor or Citizens Advice. It can save you a massive headache down the line. Don’t try to handle complicated paperwork or tricky inheritance issues on your own, especially when emotions run high.

Tips to Protect Your Share and Family

If you want to keep things simple for your loved ones, a little prep work goes a long way. Getting the jointly owned shares sorted while you’re around makes a huge difference. Here are the big things you shouldn’t ignore if you own a shared ownership home.

- Know your joint ownership type. Check your title deed or talk to your housing association or solicitor. If you’re not sure whether you're joint tenants or tenants in common, you could be setting your family up for headaches later.

- Make a clear, up-to-date will. Without a will, your share might not go where you want. In England and Wales, tenants in common can leave their share to anyone in their will. If joint tenants, your share skips the will and goes to the surviving owner. Either way, spell things out while you can.

- Consider severing the joint tenancy if it fits your wishes. If you want your share to pass to someone besides the other owner, you’ll need to change from joint tenancy to tenants in common. You just have to fill out a form (Form SEV) and send it to HM Land Registry. Most solicitors can do this for you quickly.

- Keep records of contributions. If you and your co-owner didn't split the deposit or mortgage payments 50/50, write it down. Sometimes, when disputes happen, clear records can save a lot of hassle.

- Check your mortgage and loan agreements. Some shared ownerships come with complicated mortgage clauses. Double-check what happens if one of you dies—some lenders expect the survivor to take on the full debt or force a sale.

Here’s a tip most people forget: If you bought with a partner (married or not) and things change—like divorce or a new baby—review all your ownership documents. People often leave this until it’s too late. Keep everything updated so your share (and your family) aren’t left in the lurch if the worst happens.