Timeshare Cost Comparison Calculator

Calculate Your Vacation Costs

Important note: Timeshare costs often increase over time. Annual maintenance fees typically rise 5-10% yearly, and special assessments can add unexpected costs. Most buyers underestimate these long-term expenses.

Back in the 1980s and 90s, timeshares were sold like hotcakes-glitzy presentations, free vacations, and promises of luxury getaways every year. But today? The word timeshare feels like a relic. People whisper it like a cautionary tale. So, does anyone actually do timeshares anymore? The answer isn’t yes or no. It’s more complicated-and a lot more honest-than you think.

Timeshares aren’t dead, but they’ve changed shape

Yes, people still buy timeshares. But not the way they used to. The old model-buying a week at a single resort in Florida or the Alps for $20,000 upfront, plus annual fees-is fading fast. That’s the version people remember from TV ads and high-pressure sales pitches. Today’s buyers are smarter. They’re not buying a week at one place. They’re buying access to a network.

Companies like Marriott Vacation Club, Hyatt Residence Club, and Interval International now run exchange networks. Instead of owning a fixed week at a single resort, you get points. You can use those points for different destinations, different seasons, even cruises or hotel stays. It’s less like owning a vacation home and more like a flexible travel membership. That shift has kept the industry alive, even if it’s no longer the mass-market phenomenon it once was.

Why the decline? The hidden costs and trapped owners

Most people who bought timeshares in the 90s or early 2000s didn’t realize what they were signing up for. The upfront cost was just the beginning. Annual maintenance fees? They go up every year-sometimes by 10% or more. Special assessments for new pools or roof repairs? You pay those too. And if you miss a payment? You can lose your ownership.

Then there’s the resale problem. Try selling a timeshare on eBay or Craigslist. You’ll quickly learn that most buyers won’t touch it. The market is flooded with desperate sellers offering their weeks for $1, or even free-if you take on the fees. That’s why over 80% of timeshare owners who want out can’t find a buyer. They’re stuck paying $500 to $1,500 a year just to keep the door open to a vacation they rarely use.

There’s even a dark side: timeshare exit companies. These are firms that promise to get you out of your contract-for a fee. Many are scams. Some charge $5,000 upfront and vanish. Others use fake legal threats to scare you into paying more. The Federal Trade Commission has warned consumers about this for years. And yet, people still fall for it.

Who still buys timeshares today?

It’s not the retirees on fixed incomes. It’s not the families who can’t afford to fly to Disney World every year. The new buyers? They’re usually middle-income professionals who travel regularly and want predictability. Think: a couple in their 40s who take a two-week vacation every year, always in the same region. They like knowing they’ll have a place to stay without booking months ahead. They’re not buying for profit. They’re buying for convenience.

Some buy into point systems because they travel internationally. A Hyatt point system lets them use their points in Bali, Rome, or Vancouver. Others buy into fractional ownership programs-like those offered by Virgin Holidays or The Luxe Collection-where you own a share of a luxury villa and get 4-6 weeks a year. These aren’t the old-style timeshares. They’re more like private club memberships with real property rights.

What’s replacing timeshares?

Short-term rentals have eaten the timeshare market alive. Airbnb, Vrbo, and Booking.com let you book exactly what you want, when you want it. No annual fees. No locked-in weeks. No pressure to use your week before it expires. And with rising incomes and remote work, people now prefer flexibility. A family in Auckland might book a beach house in Tairāwhiti for Christmas, a cabin in Queenstown for winter, and a city apartment in Wellington for a long weekend-all on the same platform.

Plus, vacation clubs like Onefinestay and Plum Guide offer curated luxury stays with concierge service-no ownership needed. You pay per stay, get high-end service, and walk away with no strings attached. That’s why the timeshare industry has shrunk by nearly 40% since its peak in 2007, according to the American Resort Development Association.

Is a timeshare worth it in 2025?

Let’s cut through the noise. If you’re considering a timeshare today, ask yourself these questions:

- Do you travel to the same place, every year, for at least a week?

- Do you hate booking vacations months in advance?

- Are you okay paying $1,000+ a year, forever, just to keep your access?

- Can you afford to lose that money if you change your mind?

If you answered yes to all four, a timeshare might still make sense-especially if it’s a point-based system with global exchange options. But if you’re unsure about any of them? Don’t do it. The flexibility of short-term rentals, the lower risk, and the lack of long-term obligations make them a far better deal for 95% of people.

What to do if you already own one

If you’re stuck with a timeshare you never use, don’t panic. There are legal, low-cost ways out.

- Check your contract’s rescission period. In the U.S., you usually have 5-10 days to cancel after signing. Some countries have similar rules.

- Try donating it. Organizations like Timeshare Users Group accept donations and sometimes resell them to recoup fees for owners.

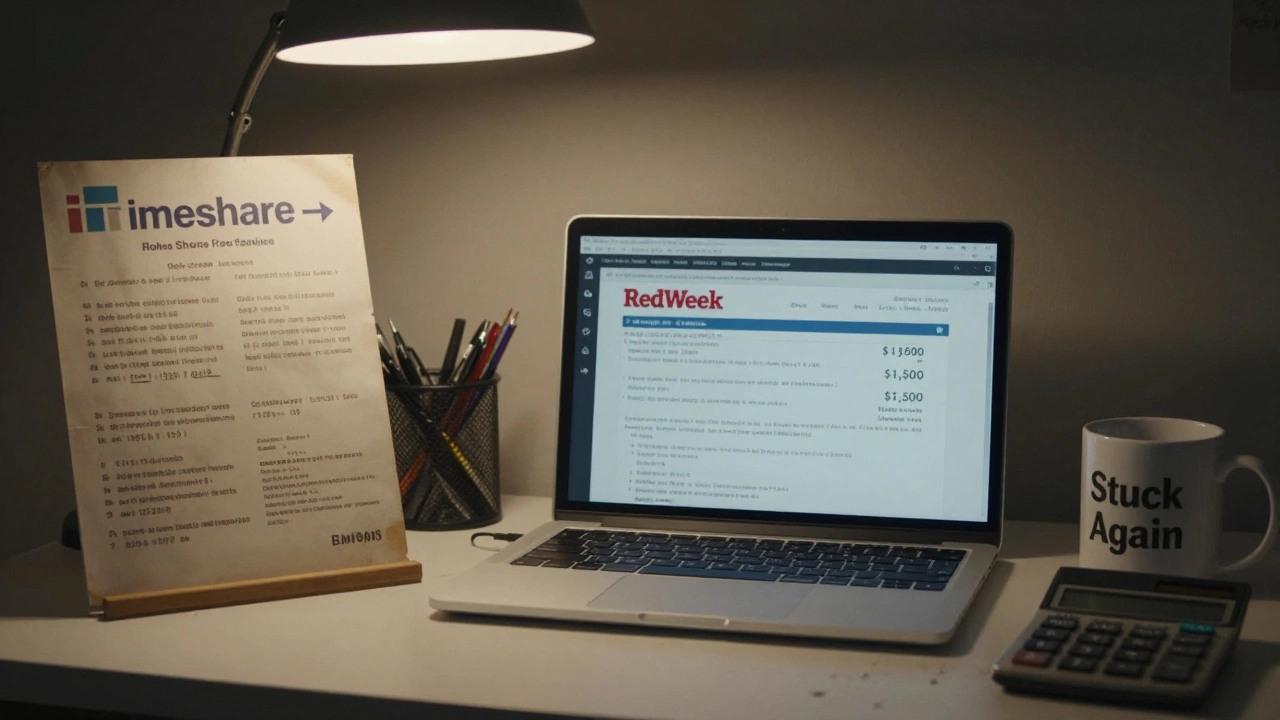

- Use official resale platforms like RedWeek or Timeshare Users Group. Don’t pay upfront fees. Only pay if it sells.

- Stop paying fees? That’s risky. It can hurt your credit and lead to collections. But if you’re truly trapped, talk to a nonprofit housing counselor-they can help you navigate options.

There’s no magic fix. But you’re not alone. Over 2 million Americans are stuck in timeshares they don’t use. The industry knows it. That’s why they’ve shifted to point systems and memberships. It’s not about selling you a week anymore. It’s about selling you a lifestyle you might not even want.

Final thought: It’s not about ownership-it’s about freedom

The real problem with timeshares isn’t that they’re expensive. It’s that they take away your freedom. You’re locked into a schedule, a location, and a cost structure that doesn’t change with your life. In 2025, freedom is more valuable than a fixed week in a resort. Whether it’s a week in Rotorua, a weekend in Queenstown, or a month in Bali, you can get it without signing a 30-year contract.

Timeshares aren’t gone. But they’re no longer the dream they were sold as. They’re a niche product for a very specific kind of traveler. For everyone else? The world is wide open-and you don’t need a key to get in.

Are timeshares still sold today?

Yes, but not like before. Most new sales are through point-based vacation clubs like Marriott or Hyatt, not fixed-week ownership. These offer more flexibility and global exchange options. The old model-buying one week at one resort-is rare today.

Can you get out of a timeshare contract?

You can, but it’s hard. Avoid exit companies that ask for upfront fees-they’re often scams. Legal options include donating to nonprofits like Timeshare Users Group, selling through trusted resale sites like RedWeek, or using your contract’s rescission period if you’re still within the cooling-off window. Never stop paying fees without legal advice-it can damage your credit.

Why are timeshares so hard to resell?

There are millions of timeshares on the market, and demand is low. Buyers don’t want the ongoing fees, and most prefer the flexibility of Airbnb or Vrbo. Resale values are often under $100, and sometimes sellers give them away for free-if you take on the annual maintenance fees.

Are timeshares a good investment?

No. Timeshares are not investments. They’re prepaid vacations with high, rising costs. Unlike real estate, they don’t appreciate. Most lose value the moment you sign. You’re paying for access, not equity. If you’re looking for property investment, consider a rental property instead.

What’s the best alternative to a timeshare?

Short-term rentals like Airbnb and Vrbo. You choose your destination, dates, and budget every time. No annual fees. No locked-in weeks. No pressure. For the same money you’d spend on a timeshare over five years, you could book 15-20 different vacations around the world.