100% Home Ownership Mortgage Calculator

Calculate your monthly mortgage payments, total costs, and stamp duty for a 100% ownership home versus shared ownership. This tool helps you understand the financial implications of full property ownership.

Compare your 100% ownership costs with shared ownership where you purchase a portion (typically 25-75%) of the property and pay rent on the remainder.

Quick Takeaways

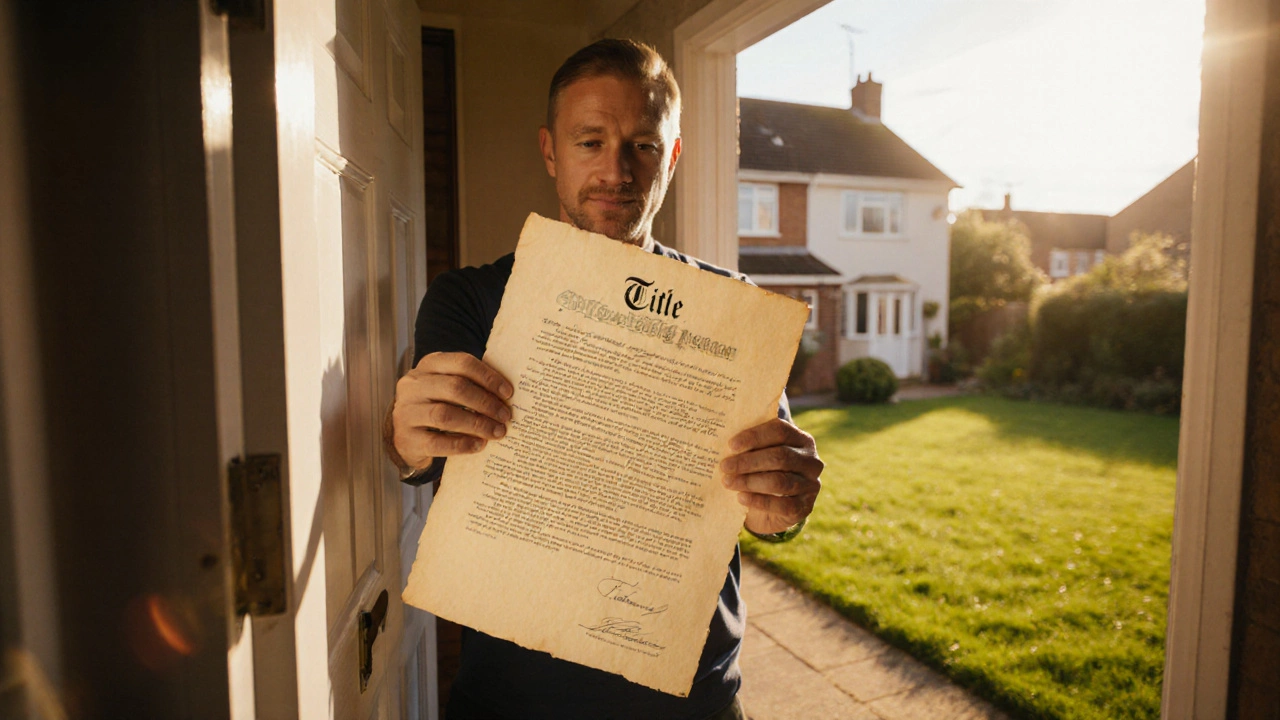

- 100% ownership means you hold the entire title of a property - no shared equity or rent‑to‑buy parts.

- It usually comes with a freehold title, but a leasehold can also be owned outright.

- Financing a 100% owned home requires a full mortgage, not the reduced loan size used in shared ownership.

- Choosing 100% ownership gives you total control over selling, remodeling, or renting out the property.

- Be aware of higher upfront costs, stamp duty, and maintenance responsibilities compared with shared schemes.

What does 100% ownership mean?

When you hear the term 100% ownership is full legal ownership of a property, meaning you hold the entire title and have complete control over the asset, think of it as the opposite of any shared‑equity arrangement. You are the sole title‑holder, so every decision - from selling the house to making extensions - rests with you.

In practice, 100% ownership can sit on either a freehold or leasehold title, depending on the land’s original ownership structure. A freehold means you own both the building and the land it stands on forever, while a leasehold gives you ownership of the building for a set number of years (often 99 or 125) but you still pay ground rent to the landowner.

How it differs from shared ownership

Shared ownership is a government‑backed or housing‑association scheme where you buy a share of a home (typically between 25% and 75%) and pay rent on the remaining portion. Over time you can ‘staircase’ - buy additional shares - until you eventually own 100%.

Key contrasts:

- Equity stake: With shared ownership you only own part of the equity; with 100% ownership you own all of it.

- Monthly outgoings: Shared owners pay a mortgage on their share plus rent on the rest. Full owners only pay a mortgage (if financed) and usual running costs.

- Resale flexibility: Selling a shared‑ownership home often requires the housing association’s consent and may involve a limited market. Full owners can sell on the open market without such restrictions.

Legal forms: Freehold vs Leasehold

Two main title types can be owned 100%:

Freehold is the outright ownership of both land and building, without any time limit. This is the most common form for detached houses and many terraced homes in New Zealand and the UK. The owner has full responsibility for maintenance, insurance, and any improvements.

Leasehold is a timed ownership of a property where the land belongs to a separate freeholder, and the leaseholder pays an annual ground rent. Modern leasehold apartments often come with service charges for communal areas. When the lease runs out, ownership reverts to the freeholder unless the lease is extended.

Whether you hold a freehold or leasehold, 100% ownership still means you own the entire share of the title you hold - there’s no hidden landlord taking a rent portion.

Financial implications

Buying a property with 100% ownership typically involves a larger mortgage and higher upfront costs than a shared‑ownership purchase.

- Mortgage is a loan secured against the property, usually paid back over 25‑30 years. Lenders will assess your income, credit score, and the amount of deposit you can provide.

- Equity is the market value of the property minus any outstanding mortgage debt. With 100% ownership, you build equity on the whole asset.

- Stamp duty (or land transfer tax) is calculated on the full purchase price, which can be a significant cash outlay.

- Maintenance, insurance, and council tax are fully your responsibility - there’s no rent component to soften the cost.

Because you’re buying the whole asset, you also reap the full upside when the market rises. A 10% increase in property value translates directly into a 10% rise in your equity, whereas a shared‑ownership buyer only benefits on the portion they own.

When to choose 100% ownership

Consider full ownership if:

- You have a sizable deposit (usually at least 10‑20% of the purchase price).

- You plan to stay in the home for a longer period (5‑10 years or more) so the costs of buying and selling are amortised.

- You want the freedom to rent out the property, add extensions, or remodel without needing approval from a housing association.

- You anticipate strong capital growth in the area and want to capture the full upside.

- You prefer a straightforward legal structure - a single title deed, no rent‑to‑buy clauses.

If any of these points don’t fit, a shared‑ownership scheme might give you a foot in the door with a lower deposit and reduced mortgage.

Step‑by‑step guide to buying a 100% ownership home

- Assess your finances. Use a mortgage calculator to see how much you can borrow based on income, existing debts, and deposit size.

- Get a mortgage in principle. A lender will issue a conditional offer stating how much they’re willing to lend.

- Find a property. Look for listings that state “freehold” or “leasehold - 100% ownership”. Estate agents often flag full‑ownership homes.

- Make an offer. Negotiate price, request a property information pack, and confirm the title type.

- Hire a solicitor or conveyancer. They will check the title register, ensure there are no restrictive covenants, and arrange the transfer of ownership.

- Conduct a survey. A home‑owner’s report or full structural survey will uncover any hidden issues that could affect value.

- Finalize mortgage approval. Submit the survey, valuation, and any required documents to the lender.

- Pay deposit and stamp duty. These are usually paid on exchange of contracts.

- Complete the purchase. On the completion date, the remaining balance is transferred, and the title deed is registered in your name.

- Move in or rent out. As the full owner, you can decide the next steps without external permission.

Common pitfalls and pro tips

- Under‑estimating costs. Include legal fees, survey fees, stamp duty, and moving expenses in your budget.

- Ignoring lease length. If you buy a leasehold property, check the remaining years. Extending a lease can be costly if the term falls below 80 years.

- Not checking service charges. For leasehold apartments, the annual service charge can be a significant ongoing expense.

- Missing out on government incentives. Some regions offer first‑time‑buyer grants for full ownership purchases. Verify eligibility.

- Skipping a professional survey. Hidden damp, structural defects, or asbestos can cost thousands to remediate.

Comparison: 100% Ownership vs Shared Ownership

| Aspect | 100% Ownership | Shared Ownership |

|---|---|---|

| Equity stake | Whole property (100%) | Partial (25‑75%) |

| Monthly payments | Mortgage only (if financed) | Mortgage on share + rent on remainder |

| Deposit required | Typically 10‑20% of full price | Often 5% of the share price |

| Resale freedom | Sell on open market any time | Seller must get housing association approval; market limited |

| Maintenance responsibility | All costs fall on owner | Owner maintains their share; landlord may handle common areas |

| Potential for capital growth | Full upside on total value | Growth applies only to owned share |

| Staircasing option | Not applicable (already 100%) | Can buy additional shares over time |

Mini FAQ

Can I convert a leasehold 100% ownership property to freehold?

In many jurisdictions you can buy the freehold from the landowner, a process called "enfranchisement". It usually requires a majority of leaseholders to agree and can involve legal fees and a premium based on the lease’s remaining term.

Do I still pay council tax if I own 100% of the home?

Yes. Council tax is based on the property’s valuation band, not on ownership percentage. Full owners pay the same amount as shared owners.

Is stamp duty higher for a 100% ownership purchase?

Stamp duty (or land transfer tax) is calculated on the full purchase price, so it will be higher in absolute terms than the duty on a shared‑ownership share. However, the rate bands are the same.

Can I rent out a 100% owned house?

Yes. As the sole title‑holder you can rent the property to tenants, provided you comply with local landlord regulations and your mortgage terms allow it.

What are the risks of buying a leasehold property with 100% ownership?

The main risks are high ground rent, costly lease extensions, and restrictions on alterations. If the lease falls below 80 years, extending it can become very expensive.

Next steps

Now that you understand what 100% ownership entails, take a few concrete actions:

- Run a quick affordability check using an online mortgage calculator.

- Contact a local mortgage broker to get a pre‑approval in principle.

- Search property portals for listings that explicitly state "freehold - 100% ownership" or "leasehold - full title".

- Arrange a meeting with a solicitor experienced in freehold and leasehold conveyancing.

- Prepare a budget that includes deposit, stamp duty, legal fees, and a contingency for unexpected repairs.

Following these steps will put you on a clear path toward owning a home outright, giving you the freedom and financial upside that many first‑time buyers chase.