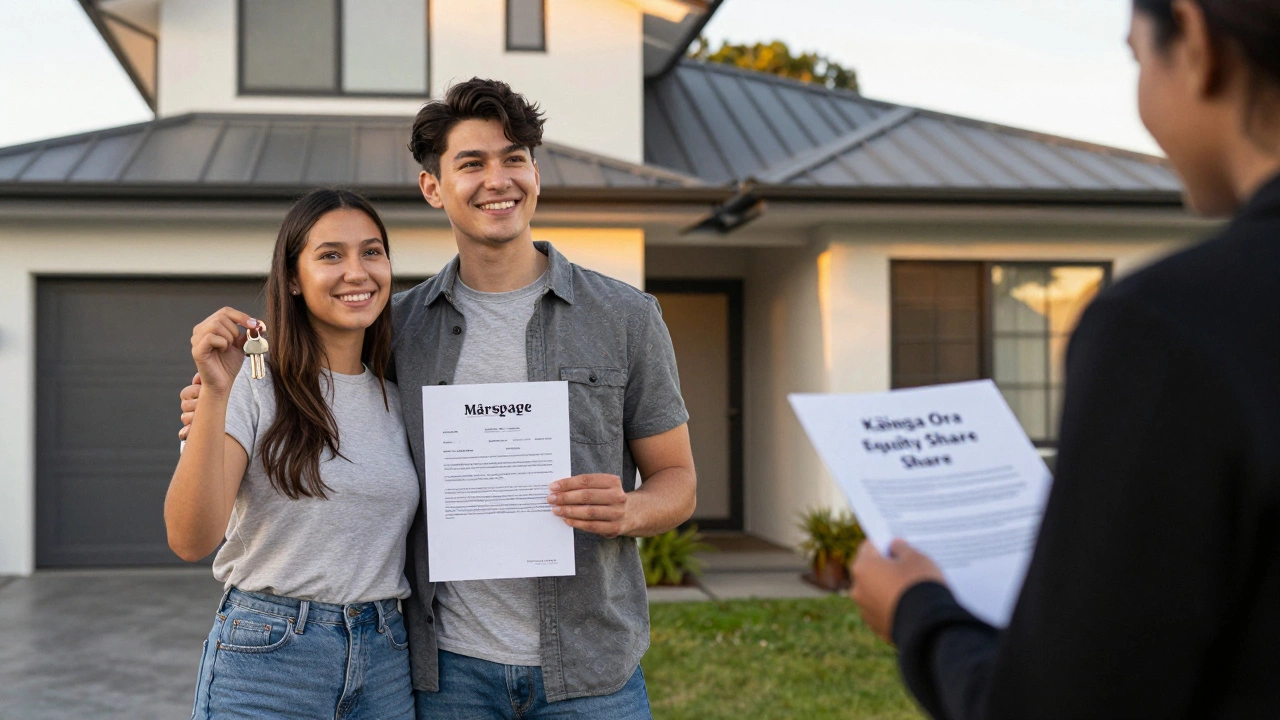

Property shares let you buy part of a home and pay rent on the rest. It's a path to homeownership for those who can't afford a full mortgage. Learn how it works, who qualifies, and how to climb toward full ownership.

Shared Ownership Homes: A Practical Guide to Buying Cheaply

If you’ve been hunting for a way to own a house without blowing your savings, shared ownership might be the answer. It’s a scheme that lets you buy a slice of a property—usually between 25% and 75%—while the housing association or a private developer keeps the rest. You pay mortgage on your share and rent on the rest, making the monthly cost far lower than a full‑mortgage payment.

How It Works in Simple Steps

First, you pick a property that’s part of a shared‑ownership scheme. Most lenders require a minimum deposit, but it’s calculated on the share you’re buying, not the full price. After the deposit, you get a mortgage for your portion and sign a tenancy agreement for the rest. Every year you can ‘staircase’—buy more shares—until you own 100% if you wish.

The rent you pay on the remaining share is usually lower than market rent because it’s set by the housing association. That rent can rise, but any increase is tied to official rent‑review rules, so it’s predictable.

Who Can Apply?

Shared ownership is aimed at first‑time buyers, those who have sold a previous home, or people who can’t afford a full mortgage. You’ll need a steady income, a good credit score, and you must meet the housing association’s criteria—often a maximum household income (around £80,000 in London, less elsewhere). The property must be your main home; it can’t be a holiday house.

Because you’re dealing with two contracts—mortgage and tenancy—getting professional advice helps. A mortgage broker familiar with shared ownership can find the right lender, and a solicitor will review the tenancy terms.

Here are three quick tips to make the most of a shared‑ownership purchase:

- Check the service charge. Some developments have high maintenance fees that can eat into your savings.

- Plan your staircase. Decide how fast you want to increase your share and budget for the extra mortgage payments.

- Know the resale rules. When you sell, the housing association usually has the first right to buy your share, which can simplify the process.

Shared ownership isn’t a one‑size‑fits‑all solution, but for many it’s a realistic route onto the property ladder. It lowers the entry cost, gives you the security of ownership, and lets you build equity over time. If you’re ready to explore options, start by browsing the listings on Pring Property Solutions—our platform flags which homes are available under shared ownership and shows the price breakdown for each share.

Remember, the key to success is to stay informed. Keep track of rent reviews, budget for staircase increments, and work with professionals who understand the nuances. With the right approach, a shared‑ownership home can be the stepping stone you need to own a house outright someday.

Shared ownership homes let married couples buy part of a home, pay lower rent on the rest, and build equity over time. It’s the smartest path to homeownership in high-cost areas like Auckland.

Share of ownership lets you buy a percentage of a home while paying rent on the rest. It’s a realistic path to homeownership for first-time buyers in high-cost markets like Auckland.

Shared equity agreements help first-time buyers get into the market, but they come with hidden rent costs, fees, and limited control. Is it a stepping stone-or a financial trap?

Co-ownership lets multiple people buy a home together, making homeownership possible when you can't afford it alone. Learn how it works in New Zealand, the types of ownership, legal risks, and what to include in a co-ownership agreement.

Learn how home shares work, from buying a share and paying rent to staircasing and eligibility, with clear steps and real‑world examples.

Ever wondered if being a shareholder in a shared ownership home means you get paid every month? This article unpacks how payments actually work, what 'shareholder' really means in this context, and the difference between shares and rental payments. Get practical tips on what to expect financially and helpful facts that clear up common misunderstandings. Find out why money doesn't hit your account the way you might expect.

This article covers everything you need to know about calculating share ownership in shared ownership homes. You'll get practical steps, real-world examples, and tips to understand exactly what you own and what you pay. Learn how your share impacts your total costs and what to watch out for. If numbers make your head spin, we've got easy breakdowns that actually make sense. Perfect for first-timers or anyone feeling lost in the jargon.

Thinking about getting your own place but can’t quite swing a full mortgage? This article breaks down how to find shared ownership homes, who can apply, and how the whole process actually works. Learn where to look, what to check, and what happens after you move in. If you’re dreaming of home but full ownership feels far off, shared ownership might be just what you need. Get the real scoop and avoid common mistakes from the start.

Joint ownership might seem like a practical solution for affordable housing, but it comes with a variety of challenges. From decision-making conflicts to financial entanglements, co-owning a property can lead to complicated situations. Understanding these issues can help potential buyers make informed decisions. This article explores why joint ownership might be more trouble than it's worth.

Timeshares, once known as a standardized approach to vacation property sharing, have evolved into more flexible shared ownership models. These modern solutions offer increased versatility and unique terms that better suit today's travelers' needs. This article explores the transformation from traditional timeshares to newer, more adaptable options, highlighting the benefits and strategies for choosing the right shared ownership experience. Readers will gain insights into different forms of vacation property sharing, providing a roadmap to discovering the best fit for their lifestyle.