Co-Ownership Mortgage Calculator

Enter Your Details

How This Works

In New Zealand, mortgage lenders typically allow you to borrow up to 5.5 times your combined income for first-home buyers. This calculator estimates your mortgage affordability based on your income, deposit, and interest rate.

For co-ownership in NZ, it's important to understand that:

• Joint tenancy means equal ownership that passes to surviving owners

• Tenancy in common allows custom ownership percentages

• A co-ownership agreement is legally required for clarity

Your Mortgage Results

Note: These figures are estimates based on standard mortgage lending practices in New Zealand. Actual rates may vary by lender. Consult a mortgage broker for precise information.

Buying a home on your own is getting harder. In Auckland, the median house price sits above $1.2 million. For most people, that’s out of reach. But what if you could buy a home with someone else? That’s where co-ownership comes in. It’s not just for friends or siblings - it’s a real path to homeownership for couples, extended family, or even trusted colleagues. But it’s not as simple as splitting the mortgage. There are rules, risks, and paperwork you can’t ignore.

What Exactly Is Co-Ownership?

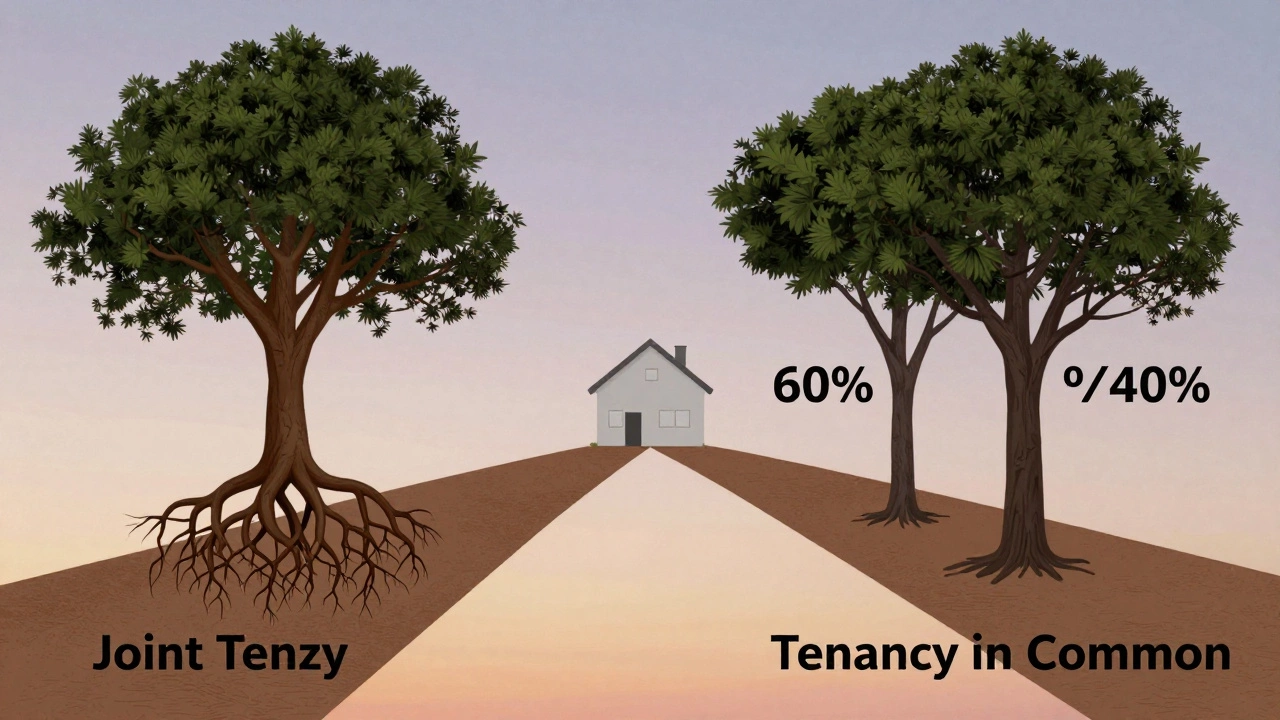

Co-ownership means two or more people legally own the same property together. It’s not renting out a room. It’s owning a share of the whole house. In New Zealand, there are two main types: joint tenancy and tenancy in common. They sound similar, but they change everything - especially if someone dies or wants out.

In joint tenancy, everyone owns the property equally. If one person dies, their share automatically goes to the others. No will needed. No probate. It’s clean. Most couples use this. But if you’re buying with a friend or parent, it might not be the best fit.

Tenancy in common lets each person own a different share. You could own 60%, your sibling owns 40%. That share can be sold, inherited, or passed on in a will. This gives you more control - but also more complexity.

How Do You Actually Buy Together?

First, you need to agree on the basics: who pays what, who lives where, and what happens if things go wrong. Most banks will lend to co-owners, but they’ll look at everyone’s income, debt, and credit history. If one person has bad credit, it could block the whole loan.

You’ll need to apply for a mortgage as a group. The lender doesn’t care if you’re partners or flatmates - they care that the total income covers the repayments. If you’re combining incomes, you might qualify for a bigger loan than you could on your own. But you’re also tied to each other’s financial choices.

Real estate agents in Auckland see this more often now. Buyers are asking: "Can we split the deposit?" "Can we use KiwiSaver together?" The answer is yes - if you’re both first-home buyers. KiwiSaver can be used for co-ownership, but you each need to meet the eligibility rules. You can’t pool your savings unless you’re both applying as first-time buyers.

The Co-Ownership Agreement: Don’t Skip This

This is the most important document you’ll ever sign - and most people skip it. A co-ownership agreement is like a prenup for property. It spells out:

- Who owns what percentage

- How bills, rates, insurance, and repairs are split

- What happens if someone wants to sell

- How decisions are made (like renovations or renting out a room)

- What happens if someone loses their job or can’t pay

- How the property is valued if someone wants out

Without this, you’re relying on trust. And trust doesn’t pay the rates when someone moves overseas or gets sick. A lawyer can draft this for around $800-$1,500. It’s not cheap, but it’s cheaper than a court battle.

One Auckland couple bought a three-bedroom home together in 2023. One partner got laid off six months later. They didn’t have an agreement. The other had to cover the full mortgage for nine months. They ended up selling at a loss - and lost $15,000 in equity. That money could’ve paid for the agreement.

What Happens If Someone Wants to Leave?

This is the big fear. What if you buy with a friend, and they get a new job in Christchurch? Or if you split with your partner? You can’t just kick them out.

If you have a co-ownership agreement, it should include an exit plan. Usually, one person gets the first right to buy the other’s share. If they can’t afford it, the property goes on the market. The sale proceeds are split based on ownership shares.

Some agreements include a formula for valuation - like using the last council valuation plus 5%. Others use a professional appraisal. The key is to decide this upfront. Otherwise, you’re stuck negotiating when emotions are high.

There’s also the option of renting out the other person’s share. But that’s risky. If they’re not living there, you’re a landlord. That means insurance changes, tax rules change, and you’re responsible for everything.

Taxes, Insurance, and Legal Risks

Co-ownership changes your tax and insurance obligations. If you’re not living in the property full-time, it might not count as your main home. That affects capital gains tax. If you sell later and made a profit, you might owe tax - even if you didn’t live there for the whole time.

Insurance is another trap. Standard home insurance policies assume one household. If you’re co-owners with non-relatives, your insurer might refuse a claim if they find out the property isn’t occupied by a single family. You need a policy that covers multiple owners. Ask your insurer directly.

And don’t forget the legal side. If one co-owner gets sued or goes bankrupt, their share of the property can be claimed by creditors. That means the house could be forced into sale - even if you’re not at fault. That’s why people often use trusts or companies to hold co-owned property. It adds a layer of protection.

Who Should Consider Co-Ownership?

Co-ownership works best when:

- You trust each other completely - not just financially, but emotionally

- Your goals align (you both want to live there long-term)

- You’re transparent about money, habits, and future plans

- You’re willing to sign a legal agreement and stick to it

It’s not ideal if:

- You’re buying with someone you barely know

- You have very different income levels or spending habits

- You’re unsure if you’ll stay in the same city

- You expect one person to pay more but don’t have a written plan

Many young professionals in Auckland are using co-ownership to get into the market. One common setup: a couple buys a two-bedroom unit, and one of them rents out the spare room to a trusted friend. That extra income helps cover the mortgage - and keeps the property affordable.

Alternatives to Co-Ownership

Co-ownership isn’t the only way. If you’re not ready to tie your finances to someone else, consider:

- First Home Buyer Grant - up to $10,000 if you meet income and house price limits

- KiwiBuild - government-assisted homes with lower price points

- Family guarantee - a parent guarantees your loan, so you don’t need a deposit

- Shared equity schemes - like Housing New Zealand’s partnership model, where they own part of your home

These options don’t tie you to another person. But they come with their own rules - like income caps, location restrictions, or waiting lists.

Final Thoughts: Is It Right for You?

Co-ownership can be the key to owning a home when you can’t do it alone. But it’s not a shortcut. It’s a partnership with legal, financial, and emotional weight. The people who succeed are the ones who treat it like a business - not a favor.

Start with a conversation. Not just about money - but about values. What does home mean to each of you? What happens if life changes? Who cleans the gutters? Who pays for the new roof?

Then, get the agreement written. Talk to a lawyer. Talk to your bank. Don’t rush. If you do it right, co-ownership can be the smartest financial decision you ever make.

Can I use KiwiSaver for co-ownership?

Yes, if you’re both first-home buyers and meet the eligibility rules. Each person can withdraw their own KiwiSaver savings for a deposit. You can’t combine savings unless you’re both applying as first-time buyers. The property must be in New Zealand and under the price cap for your region.

What if one co-owner stops paying their share?

If there’s a co-ownership agreement, it should outline what happens. Usually, the other owner can pay the missed amount and then claim it back later - either through a higher share of equity or a repayment plan. Without an agreement, the lender can pursue any owner for the full amount. You could end up paying for someone else’s mistake.

Do co-owners pay more tax?

It depends. If you live in the home as your main residence, you usually don’t pay tax on capital gains. But if you rent out part of it or don’t live there full-time, you might owe tax when you sell. Each owner reports their share of income and expenses. Talk to an accountant before you buy.

Can I sell my share without selling the whole house?

Yes - but only if your co-ownership agreement allows it. Most agreements give the other owner(s) the first right to buy your share. If they decline, you can sell to someone else - but the new person would need to be approved by the lender and the other owners. Banks don’t like new co-owners popping up unexpectedly.

Is co-ownership better than renting?

If you plan to stay in the area for five years or more, yes. Renting doesn’t build equity. With co-ownership, even a small share grows in value. You also have control over the property - you can renovate, pet-friendly rules, no landlord inspections. But you’re responsible for repairs and costs. Renting is simpler, but you’re throwing money away.

If you’re considering co-ownership, start with a clear conversation, get legal advice, and don’t let emotion override the numbers. The right partnership can open doors. The wrong one can cost you everything.