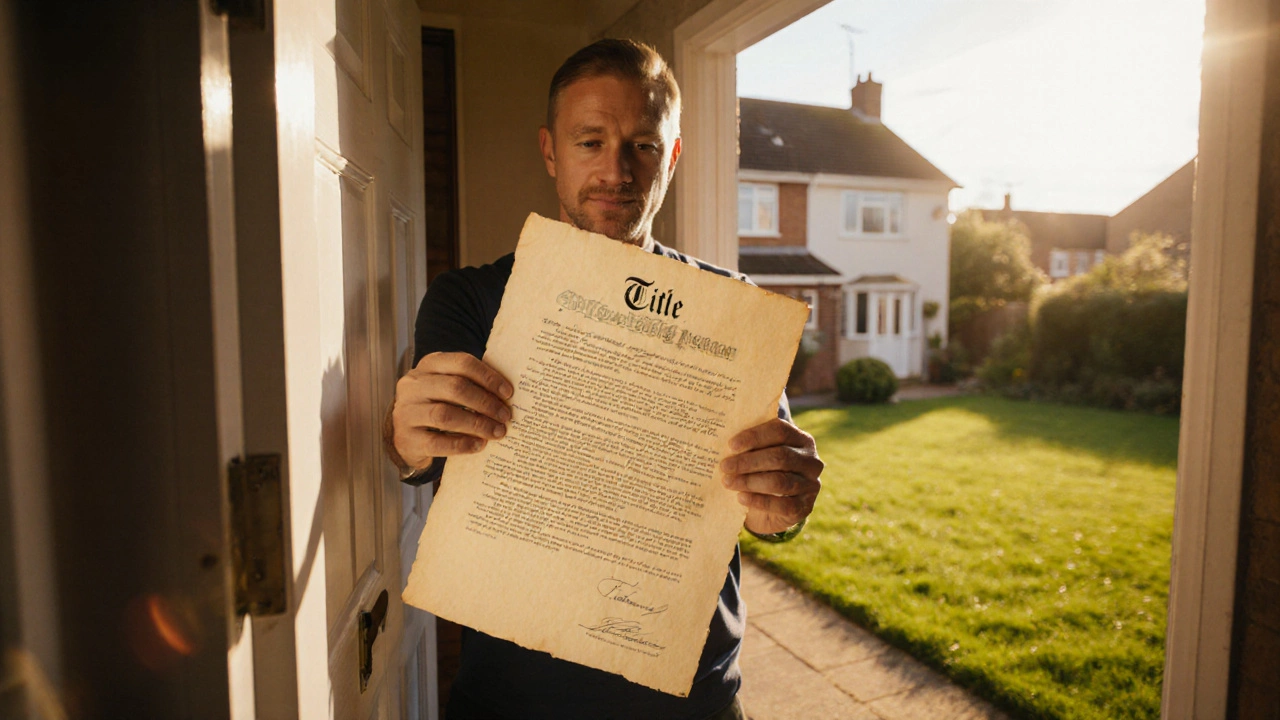

Explore what 100% ownership means, how it differs from shared ownership, legal forms, financial impacts, and step‑by‑step guidance for buying a home outright.

Leasehold

When dealing with Leasehold, a property arrangement where you own the building but pay rent for the land underneath. Also known as ground lease, it creates a set period—often 99 or 125 years—during which you hold the leasehold interest. Many first‑time buyers run into Shared Ownership, a scheme that lets you buy a share of a property and pay rent on the rest. This model is tightly linked to Staircasing, the process of buying additional shares over time to increase your ownership percentage. Joint Ownership, where two or more people hold title together, often intersects with leasehold because the lease terms apply to all owners equally. Understanding how these pieces fit together saves you money, avoids nasty surprises, and helps you plan a clear path to full ownership.

How the Pieces Connect

Leasehold encompasses shared ownership, meaning any shared‑ownership property that sits on leasehold land inherits the same ground‑rent obligations and service‑charge rules. Shared ownership requires staircasing if you want to move from a 25% share to full ownership, and each staircasing step triggers a new valuation and possibly a fresh lease extension fee. Joint ownership influences leasehold considerations because the lease agreement must name all parties, and any sale or transfer needs the landlord’s consent. In practice, a buyer who grabs a 40% shared‑ownership leasehold flat will first calculate ground rent, then factor in the cost of staircasing to 60% or 100%, and finally ensure that all joint owners agree on the timing and financing. These relationships create a chain: leasehold sets the framework, shared ownership offers an entry point, staircasing provides the upgrade route, and joint ownership determines who makes the decisions.

Knowing these links lets you spot red flags early—like a looming lease expiry, high ground‑rent escalations, or staircasing costs that outweigh the benefits. It also opens up strategies: you might negotiate a lease extension before you start staircasing, or you could structure joint ownership with clear buy‑out clauses to avoid disputes later. Below you’ll find articles that break down each part in plain language, walk you through real‑world calculations, and share tips on navigating lease extensions, staircasing fees, and joint‑owner agreements. Dive in to get the actionable knowledge you need before you sign any leasehold or shared‑ownership deal.