Shared Ownership Equity Calculator

Calculate how your share of a property grows in value based on annual appreciation. This helps you understand potential long-term financial benefits of shared ownership.

Your Equity Projected Value

When you own a share of a home through a shared ownership scheme, you might think paying yourself is as simple as taking money from your bank account. But it’s not. You’re not a traditional business owner with a payroll. You’re part-owner of a home, often with a housing association holding the rest. So how do you actually pay yourself? The answer isn’t about salary-it’s about how you manage cash flow, equity, and long-term financial health.

Shared ownership isn’t a business, but your finances still need structure

Most people who enter shared ownership do so because they can’t afford to buy a home outright. You might own 25%, 50%, or 75% of your property. The rest is owned by a housing association, and you pay rent on that portion. Your monthly payments include your mortgage on your share and rent on the rest. That’s it. There’s no company. No profit. No dividends. So when you ask, “How do I pay myself?”-you’re really asking: How do I turn my home ownership into reliable personal income?

The key is understanding that your home isn’t a paycheck. It’s an asset. And like any asset, you can unlock value from it-but only in specific, controlled ways.

Option 1: Build equity, then cash out (slowly)

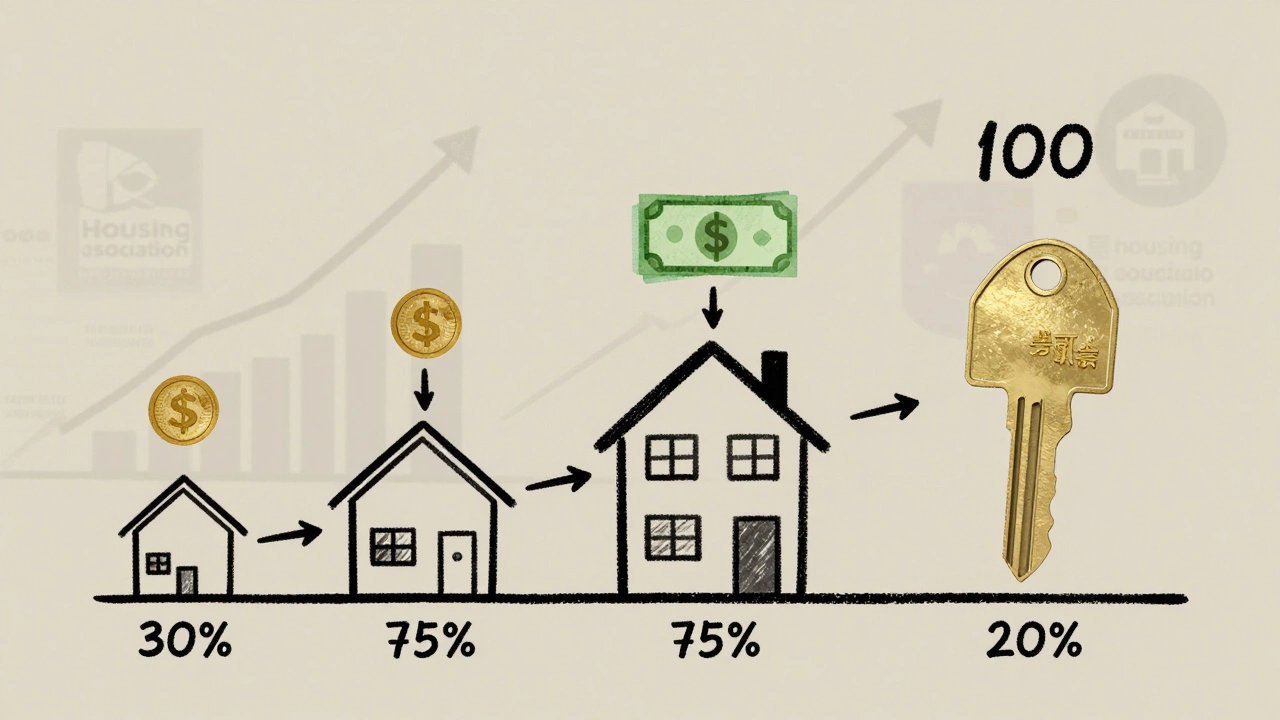

The most common and safest way to “pay yourself” is through staircasing-buying more shares in your home over time. Let’s say you started with 30% of a $500,000 home. That’s $150,000 equity. After five years, the home’s value rises to $600,000. Your 30% share is now worth $180,000. You’ve gained $30,000 in equity, even if you didn’t pay extra.

That’s not income. But if you staircase to 75%, then sell your share, you get that $180,000 in cash. You can use it to buy another home, pay off debt, or fund retirement. That’s how you turn ownership into money.

But here’s the catch: you can’t just take $500 a month out of that equity. Housing associations don’t let you withdraw equity like a bank account. You have to sell, or buy more. And if you sell, you give up your home.

Option 2: Rent out your share (with permission)

Some shared ownership agreements allow you to sublet your portion-especially if you need to move for work or family. But this isn’t common. Most housing associations require you to live in the property as your primary residence.

If your agreement does allow it, you can rent out your share. Let’s say you own 50% of a $500,000 home. You rent out your half for $1,200 a month. That’s $14,400 a year in income. But you still pay rent on the other half. And you still pay your mortgage. So your net gain might be $400-$700 a month after costs.

This works best if you’re relocating temporarily. But it’s risky. If you’re caught subletting without permission, you could lose your home. Always check your lease. Always get written approval.

Option 3: Use your equity as collateral for a loan

Some banks in New Zealand let you borrow against your shared ownership equity. You don’t sell. You don’t move. You just take out a secured loan using your share as security.

For example: You own 60% of a home worth $650,000. That’s $390,000 in equity. A lender might let you borrow up to 80% of that-$312,000. You could take out $50,000 to pay off credit cards, fund a business, or cover medical bills. You’re not “paying yourself.” You’re borrowing against your asset.

This has risks. Interest rates on these loans are often higher than standard mortgages. If you can’t repay, the lender could force a sale. And if your home’s value drops, you could owe more than your share is worth.

Option 4: Make your home work for you (rental income from the whole property)

Here’s a real-world example from Auckland: A couple bought a 50% share in a three-bedroom home in Mt Roskill through a shared ownership scheme. They lived there for three years, then moved to a rental in Ponsonda. They asked their housing association if they could rent out the whole property. The answer was no.

But another family in Papakura did something smarter. They bought 75% of a two-bedroom unit. They used the spare room as a short-term rental through Airbnb. They kept the rest for themselves. They got approval from the housing association because they still lived there most of the time. They made $300 a week from the room. That’s $15,600 a year. They used it to cover their mortgage and rent payments-and still had $8,000 left over.

This isn’t for everyone. But if you have space, and your agreement allows it, this is one of the few ways to generate real, recurring income from shared ownership.

What you can’t do

There are three big myths about paying yourself in shared ownership:

- You can’t draw a salary. There’s no company. No payroll. No employer.

- You can’t take money from rent payments. The rent you pay to the housing association isn’t income. It’s a cost.

- You can’t borrow against the whole property. You only own your share. Lenders only lend against your portion.

Trying to treat shared ownership like a business will get you into trouble. The system is designed to help you get on the property ladder-not to generate income.

How to plan your finances around shared ownership

If you want to “pay yourself” from your shared ownership home, you need a long-term plan. Here’s how:

- Track your equity. Every year, get your home valued. Know how much your share is worth.

- Save for staircasing. Put aside a fixed amount each month to buy more shares. Even $200 a month adds up.

- Build an emergency fund. You’re not just paying a mortgage-you’re paying rent too. Unexpected repairs or job loss can hit hard.

- Use your home as leverage, not cash. Only borrow against equity if you have a clear plan to repay it.

- Know your lease. Read it. Keep a copy. Know what you can and can’t do.

In Auckland, the average shared ownership property increases in value by 5-7% a year. That’s faster than inflation. So even if you never buy more shares, your equity grows. That’s your real paycheck.

When to sell your share

There’s no right time to sell. But here are signs it might be the right move:

- You’ve staircased to 100% and want to move.

- You need a large sum of cash (for medical bills, education, or starting a business).

- You’ve moved out of Auckland and can’t rent out the property.

- The housing association’s rent increases are eating into your budget.

Selling your share doesn’t mean failure. It means you’ve built enough value to move on. Many people use the money from selling their shared ownership home to buy a fully owned property elsewhere.

Real people, real outcomes

Anna, 34, bought 40% of a two-bedroom flat in Onehunga in 2020. She paid $220,000 for her share. In 2025, the home was valued at $720,000. Her 40% share was worth $288,000. She’d paid off $30,000 of her mortgage. That meant $68,000 in equity growth-just from rising prices.

She used $40,000 of that to buy a 75% share in a new home in Manukau. She kept the old flat and rented it out (with permission). She now owns two homes. One pays her rent. The other is her primary residence.

That’s how you pay yourself. Not with a salary. With patience, planning, and smart equity use.

Final thought: Your home is your best financial tool

You won’t find a guide that says, “How to take $1,000 out of your shared ownership home this month.” That’s not how it works. But if you treat your share like a long-term investment-not a bank account-you’ll build real wealth.

Shared ownership isn’t about instant cash. It’s about access. And access, over time, becomes ownership. And ownership, over time, becomes freedom.

Can I pay myself a salary from my shared ownership home?

No. Shared ownership is not a business. You don’t own the whole property, and there’s no company structure to pay yourself a salary. Your income must come from outside sources-your job, side gigs, or cashing out equity through sale or loan.

Can I rent out my shared ownership home?

Only if your housing association allows it. Most shared ownership agreements require you to live in the property as your main home. Subletting without permission can lead to eviction. Always check your lease and get written approval before renting out any part of your home.

How do I increase my equity in a shared ownership home?

You buy more shares in a process called staircasing. Contact your housing association to find out how much it costs to buy an additional 10%, 25%, or 50%. You’ll need a mortgage valuation, and you may need to pay legal and administrative fees. Each time you staircase, your rent decreases because you own a larger portion.

Can I get a loan using my shared ownership equity?

Yes, but only some lenders offer this. You can borrow against the value of your share-not the whole property. Lenders will require a formal valuation and may charge higher interest rates than standard mortgages. Make sure you can repay the loan before taking one out.

What happens if my home’s value drops?

You still owe the same mortgage amount. If your home loses value, your equity shrinks. You can’t sell for less than you owe without covering the difference. That’s why it’s important to buy within your means and avoid borrowing too much against your share.