Credit Score Mortgage Calculator

Calculate Your Mortgage Costs

Savings with higher credit score: At a 750+ score, you could save $12,000 in interest over the loan term.

If you're a first-time buyer eyeing a $300k home, your credit score isn’t just a number-it’s the key that unlocks your mortgage. Lenders don’t care how much you make if they don’t trust you’ll pay them back. And while $300k might sound like a stretch, it’s actually within reach for many in New Zealand right now, especially with government support and low-deposit options. But here’s the hard truth: credit score matters more than your savings in many cases.

What’s the minimum credit score to buy a $300k house?

In New Zealand, there’s no single magic number like in the U.S., but lenders generally look for a score of at least 600-650 on the Equifax scale (which runs from 0 to 1200). That’s the baseline. If you’re below 600, you’ll struggle to get approved without a co-signer or a huge deposit. If you’re above 700, you’re in the sweet spot-better rates, more lender options, and faster approvals.

For a $300k house, most banks want you to have at least a 10% deposit ($30k). But if your credit score is 750 or higher, some lenders will let you put down as little as 5% ($15k) and still approve you. That’s the difference between saving for five years and saving for two.

Why credit score matters more than you think

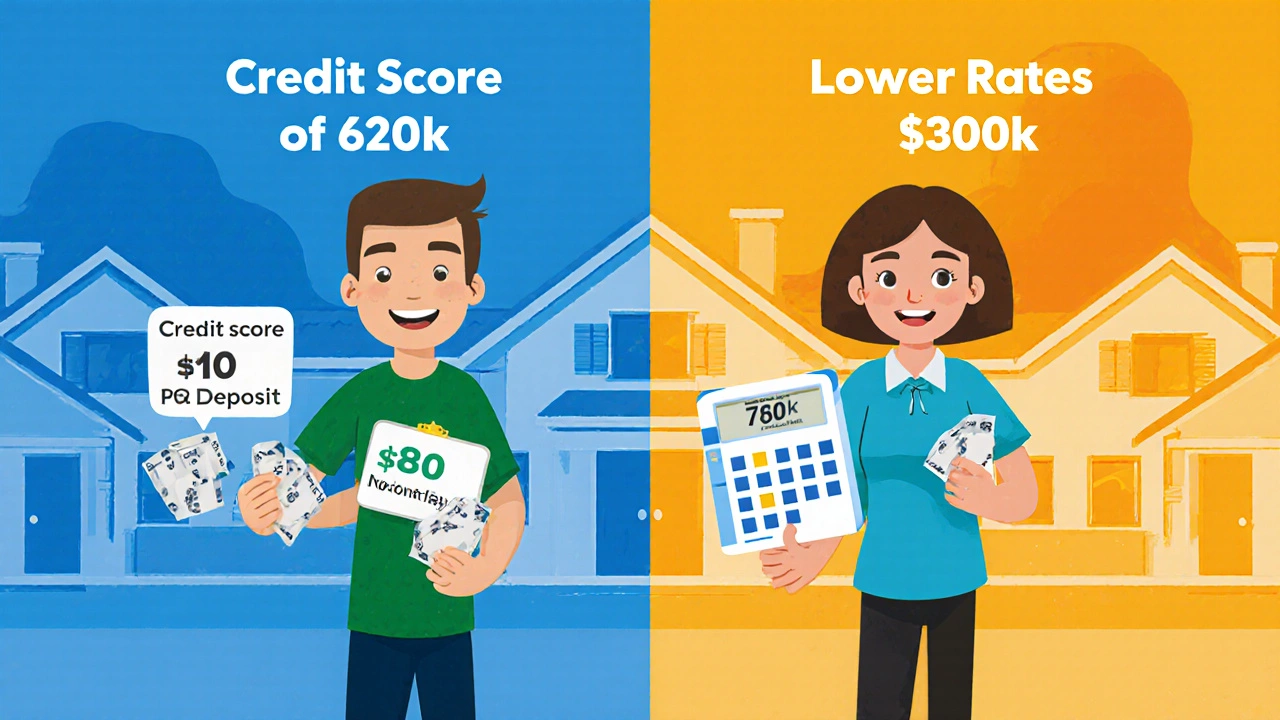

It’s not just about getting approved. Your credit score determines your interest rate. Let’s say you’re buying a $300k home with a 25-year mortgage. If your credit score is 620, you might get a rate of 7.5%. If it’s 760, you could get 6.2%. That’s a $180 difference per month. Over 25 years, that’s over $54,000 in extra interest paid. That’s a used car. Or a year’s rent. Or a deposit on a second property.

Some first-time buyers think they can just save up and walk in. But banks run a full credit check before even looking at your income. If your score is low because of missed payments, high credit card balances, or too many recent loan applications, you’ll get rejected-even with a 20% deposit.

What lowers your credit score (and how to fix it)

Here’s what actually hurts your score in New Zealand:

- Missing a credit card or loan payment-even one late payment can drop your score by 50+ points

- Maxing out your credit cards (use more than 30% of your limit)

- Applying for multiple loans or credit cards in a short time

- Having defaults or court judgments on your record

- Not having any credit history at all (yes, that’s a problem too)

Fixing this isn’t about quick hacks. It’s about consistency. Pay every bill on time, even if it’s just the minimum. Keep your credit card balances under 30% of your limit. Don’t open new accounts while you’re applying for a mortgage. And if you’ve got defaults, get them paid off and ask for a letter of clearance from the creditor.

One real example: A 28-year-old teacher in Hamilton had a score of 580 because she’d missed two phone bill payments two years ago. She paid them off, waited six months, and then used a free credit report from Equifax to confirm her score had jumped to 710. She got her $300k mortgage approved with a 5% deposit and a rate of 6.4%.

How to check your credit score for free

You’re entitled to one free credit report every year in New Zealand. But you can get it every month if you sign up for a free trial with Equifax or illion. Just make sure you cancel before the trial ends-don’t get charged.

Here’s how to do it:

- Go to Equifax.co.nz or illion.co.nz

- Click "Free Credit Report"

- Verify your identity with your driver’s license or passport

- Download your report and look for your score (it’s usually at the top)

- Check for errors: wrong addresses, accounts you didn’t open, late payments that were actually paid

If you find an error, dispute it immediately. Correcting one mistake can raise your score by 80 points. That’s the difference between rejection and approval.

What if your score is still too low?

You’re not out of options. Here’s what works:

- Use the First Home Buyer Grant-if you’re earning under $120k (individual) or $180k (couple), and buying a new or existing home under $800k, you could get up to $10k from the government. That helps your deposit.

- Get a guarantor-a parent or close relative can use their equity in their home to back your loan. This lets you borrow with a 0% deposit if needed.

- Start with a smaller home-a $220k townhouse in Papakura might be easier to qualify for than a $300k house in Ponsonby. You can always upgrade later.

- Wait 6-12 months-if you fix your credit habits now, your score will climb. Use that time to save more, reduce debt, and build a stronger application.

One couple in Tauranga had scores of 590 and 610. They didn’t buy a $300k house. They bought a $210k unit, used the First Home Buyer Grant, and paid it off in four years. Now they’re refinancing to buy their $300k family home-with scores of 770 and 790.

What lenders look for beyond your score

Your credit score is just the first filter. After that, lenders check:

- Your income stability (pay slips from the last three months)

- Your debt-to-income ratio (how much you owe vs. how much you earn)

- Your savings history (do you have a pattern of saving, or just a last-minute deposit?)

- Your living expenses (do you spend $1,200 a month on takeaways and subscriptions?)

Even with a perfect score, if you’re spending every dollar you earn and have no savings history, lenders will say no. They want to see you’ve been living within your means for at least six months.

Realistic timeline: From zero to $300k home

Here’s what a realistic path looks like:

- Month 1-2: Get your credit report. Fix errors. Pay off one small debt.

- Month 3-6: Stop using credit cards for daily spending. Pay all bills on time. Start saving $500/month.

- Month 7-9: Check your score again. If it’s above 650, talk to a mortgage broker.

- Month 10-12: Apply for the First Home Buyer Grant. Get pre-approved for a loan.

- Month 13+: Start looking at homes. You’re ready.

This isn’t fast. But it’s reliable. And it keeps you from getting rejected, which can hurt your score even more.

What happens if you get rejected?

One rejection won’t kill your chances-but three in six months will. Each application leaves a hard inquiry on your report. Too many, and lenders think you’re desperate. They assume you’re overextended.

If you get turned down, ask for the reason. Most banks will tell you. Then fix that one thing before applying again. Don’t just reapply with another lender. That’s how people get stuck in a cycle of rejection.

Final tip: Talk to a mortgage broker

Banks have their own rules. A mortgage broker knows them all. They can tell you which lender is easiest for first-time buyers with a 640 score. They can help you structure your application so it passes automated filters. And they don’t charge you-lenders pay them.

Don’t go it alone. A good broker can save you months and thousands of dollars.

Can I buy a $300k house with a credit score of 600?

Yes, but it’s harder. You’ll likely need a 15-20% deposit ($45k-$60k), and your interest rate will be higher. Some lenders may require a guarantor. It’s possible, but you’ll pay more over time. Improving your score to 700+ gives you better options and lower costs.

Does having no credit history hurt my chances?

Yes. Lenders need to see how you handle debt. If you’ve never had a credit card, phone plan, or loan, you’re a blank slate. Start small: get a low-limit credit card, use it for one monthly bill (like Netflix), and pay it off in full every month. After six months, you’ll have a track record.

How long does it take to improve a credit score?

You can see improvement in 3-6 months if you pay bills on time, reduce credit card balances, and avoid new credit applications. Major improvements (like going from 580 to 700) usually take 9-12 months of consistent behavior. There’s no overnight fix.

Can I use KiwiSaver to help buy a $300k house?

Yes-if you’ve been contributing for at least three years, you can withdraw your contributions and employer contributions (but not the government kick-in) for a first home. You can also apply for the First Home Buyer Grant. Together, these can cover 10-20% of a $300k purchase.

Do I need a deposit if my credit score is high?

Even with a 780 score, most lenders still require at least a 5% deposit ($15k for a $300k home). Some specialist lenders offer 0% deposit loans with a guarantor, but those are rare and come with strict conditions. Having a deposit shows you’re serious and reduces the lender’s risk.

Next steps: What to do today

Don’t wait for the perfect score. Start now:

- Get your free credit report from Equifax or illion-today.

- Check for errors and dispute them.

- Set up automatic payments for all your bills.

- Open a dedicated savings account and put in $200 this week.

- Book a free 30-minute chat with a mortgage broker.

Buying your first home isn’t about being rich. It’s about being responsible. And that starts with your credit score.