Explore what 100% ownership means, how it differs from shared ownership, legal forms, financial impacts, and step‑by‑step guidance for buying a home outright.

Property Ownership: What You Need to Know

Thinking about buying a place? Knowing how ownership works can save you time, money, and headaches. In the UK, there are a few common ways to own a property, each with its own rules and benefits. Let’s break them down so you can pick the right one for your situation.

Joint ownership for couples and families

If you’re married or in a civil partnership, you’ll often hear about "joint tenancy" or "tenancy by the entirety." Both partners own the whole property together. When one person dies, the other automatically inherits the full share without going through probate. This can be handy for estate planning, but it also means both owners are equally responsible for the mortgage and any debts tied to the home.

For unmarried couples, "joint tenancy" still works, but it comes with a twist: if one owner wants out, they can sell their share and the other person can buy them out. Some people prefer "tenants in common" instead, where each person owns a specific percentage—say 60% and 40%. This setup lets you leave your portion to anyone in your will, but it also means you’ll need to agree on what to do if one wants to sell.

Shared ownership and buying a slice of a house

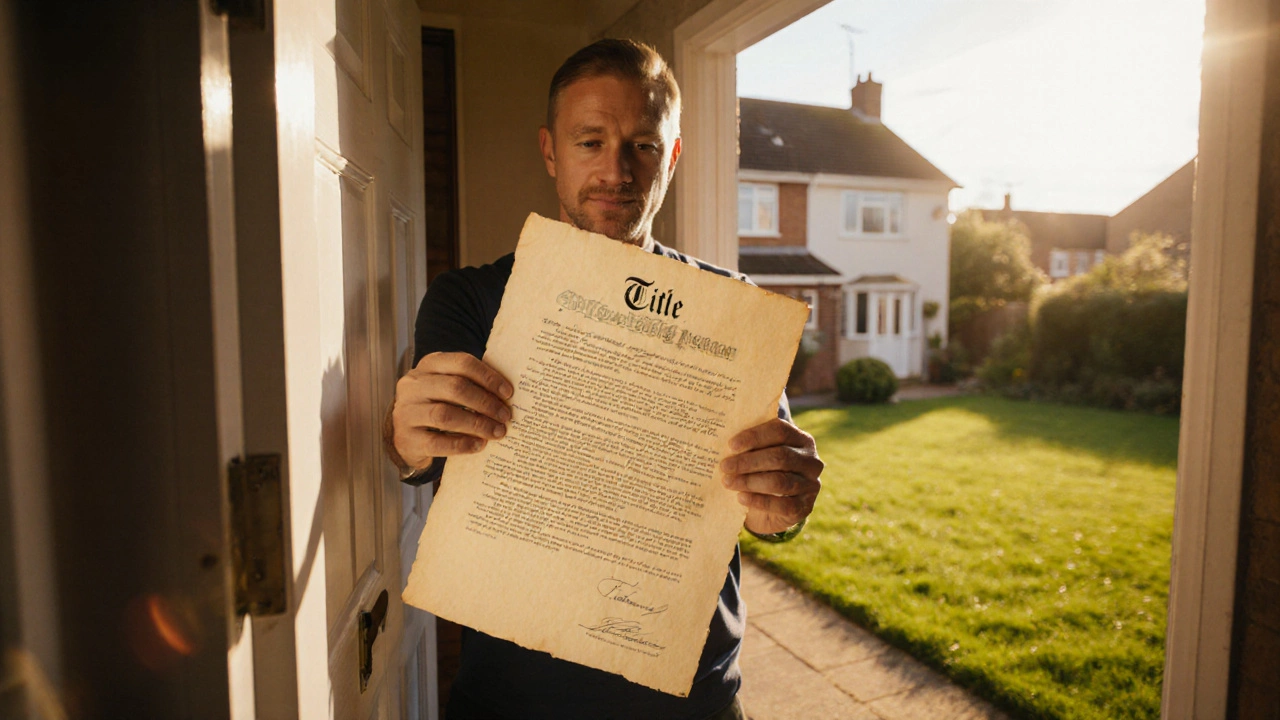

Shared ownership lets you buy a smaller share of a property—often 25% to 75%—and pay rent on the rest. It’s a good option if you can’t afford a full mortgage yet. Over time, you can purchase additional shares, a process called "staircasing," until you own 100%.

Another angle is buying shares in a house with friends or family. Think of it like a partnership: you each put in cash, own a percentage, and share the costs. This can work well for investment properties, but make sure you have a clear agreement about who pays what, who can move in, and what happens if someone wants out.

Even buying a tiny 10% stake in a company that owns property can matter. With a 10% equity stake, you get voting rights and a slice of any profit, but you also face limits on control and may need to watch for dilution if new investors join.

When you own any part of a home, you’ll need to think about taxes, insurance, and maintenance. Property tax is usually based on the whole value, so you’ll split the bill according to your share. Insurance should cover the full building, and each owner should contribute to the premium proportionally.

Before you sign anything, get a solicitor to review the contract. Ask about what happens if one owner can’t keep up with payments, how to handle repairs, and how to break the ownership if life changes.

Bottom line: whether you’re buying with a partner, a friend, or through a shared‑ownership scheme, understanding the type of ownership you’re entering is key. Choose the structure that matches your financial goals and personal situation, and you’ll be on solid ground as you step into your new home.

Shares of ownership let people buy a part of a home, making it easier to get on the property ladder without a huge deposit. This article breaks down what shares of ownership actually mean, how much control you get, and what you need to know about costs and responsibilities. You'll find tips on avoiding common mistakes and how to know if shared ownership is right for you. Expect real-world examples and clear info, not stuffy jargon. Perfect for anyone thinking about buying their first place or just curious how shared ownership really works.

Shared ownership is often misunderstood as similar to a timeshare, but they are distinctly different concepts. While both involve multiple parties sharing property rights, shared ownership focuses more on co-owning a home, whereas timeshares relate to vacation property time allotments. This article explores the differences, benefits, and potential drawbacks of shared ownership compared to timeshares. Additionally, discover important tips and considerations for those interested in exploring shared ownership options.

Shared ownership is a housing arrangement where individuals can purchase a portion of a property and pay rent on the remaining share. This model offers an affordable path to homeownership, allowing more people to step onto the property ladder. It's particularly popular among first-time buyers seeking flexibility and lower financial barriers. The scheme is designed to facilitate gradual property ownership over time.

Fractional ownership in real estate offers a unique way for individuals to invest in property by sharing ownership with others. While this approach can make property investment more accessible, it comes with certain drawbacks. Potential issues include management complexities, limited control, and potential conflicts among co-owners. It is crucial to understand these challenges to make informed decisions.