Explore what 100% ownership means, how it differs from shared ownership, legal forms, financial impacts, and step‑by‑step guidance for buying a home outright.

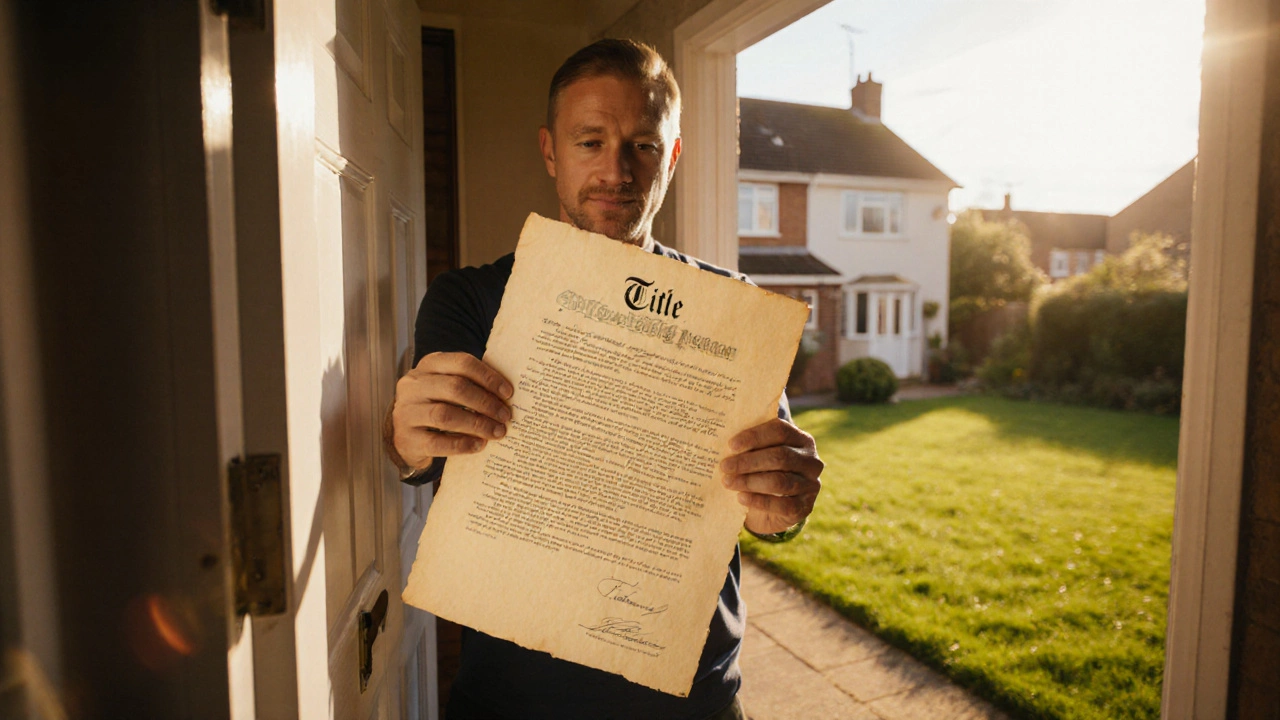

Freehold Explained – Full Ownership, Benefits, and How It Fits Into Modern Property Buying

When talking about Freehold, the outright ownership of land and any buildings on it without a time limit. Also known as fee simple, it gives you permanent control over the property and the right to sell, lease or modify it as you wish. Freehold sits opposite Leasehold, a temporary right to use a property for a set number of years, and it often appears in Shared Ownership, a hybrid model where you own a share of the freehold and pay rent on the rest. To actually acquire a freehold home you’ll usually need a Mortgage, a loan secured against the property that spreads the purchase price over many years, plus a solid down payment to satisfy lenders. This mix of concepts forms the backbone of most property transactions you’ll see on our site.

Why Freehold Matters for Buyers

Understanding the link between Leasehold, its limited-term rights and ground rent obligations and freehold helps you avoid costly surprises. For example, a leasehold property may require you to renegotiate the lease after 70‑80 years, while a freehold stays yours forever. Joint Ownership, two or more people holding title together, often as tenants in common can be combined with freehold to let friends or family split the equity while keeping full control. The amount you need for a Down Payment, typically 5‑20 % of the purchase price, directly influences which freehold properties are within reach. First‑time buyers often rely on government‑backed schemes that lower the required deposit, making freehold homes more accessible. At the same time, property taxes and maintenance costs are tied to freehold ownership, so budgeting for council tax, insurance, and repairs becomes part of the long‑term plan.

When you know how to value a freehold property, you can make smarter offers. Valuation tools consider the land value, building condition, and any comparable sales in the area. Because you own the land outright, any improvements you make—like extensions or garden landscaping—add directly to your equity. Financing options also differ: some lenders offer better rates for freehold homes, viewing them as lower risk than leaseholds that may lose value as the lease shortens. Finally, understanding the legal framework—title deeds, registry entries, and any covenants—protects you from hidden restrictions. All of these pieces—ownership type, financing, payment, and legal checks—interact to shape a successful freehold purchase.

Below you’ll find a curated list of articles that dive deeper into each of these topics. From step‑by‑step guides on securing a mortgage for a freehold home to tips on comparing leasehold and freehold costs, the collection is designed to give you actionable insights and clear next steps, no matter where you are in the buying journey.