Down Payment Impact Calculator

Calculate Your Mortgage Costs

See how much you'll pay over the life of a mortgage with different down payment percentages. Compare the impact of 0%, 5%, and 10% down payments in New Zealand.

Your Mortgage Comparison

0% Down

Monthly Payment:

Total Interest:

Mortgage Insurance:

Underwater at 5% drop:

5% Down

Monthly Payment:

Total Interest:

Mortgage Insurance:

Underwater at 5% drop:

10% Down

Monthly Payment:

Total Interest:

Mortgage Insurance:

Underwater at 5% drop:

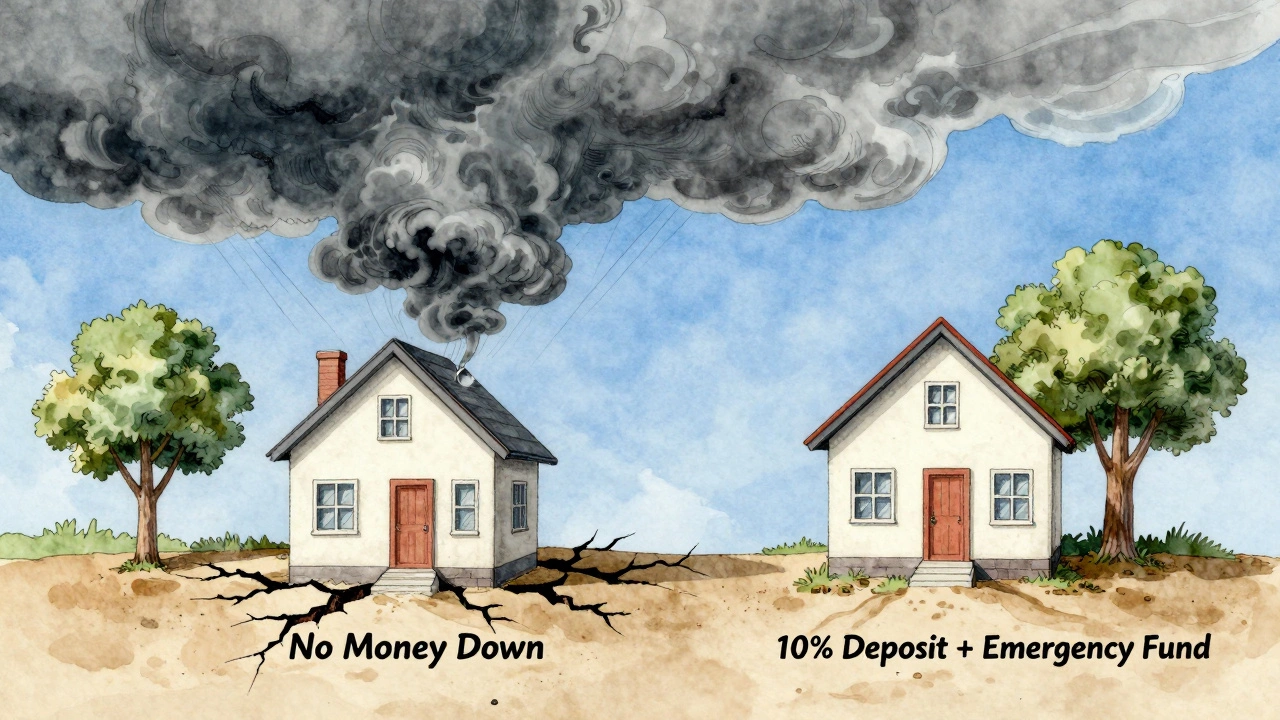

Buying a house with no money down sounds like a dream. No savings? No problem. You just sign the papers and walk into your own home. But here’s the truth: if you’re a first-time buyer in New Zealand, jumping into a no-money-down deal might feel like a shortcut - but it’s often a trap with hidden costs you can’t see until it’s too late.

What Does ‘No Money Down’ Really Mean?

When someone says ‘no money down,’ they’re usually talking about a loan that covers 100% of the home’s price. In New Zealand, this isn’t common with regular banks. Most lenders still require at least a 10% deposit. But there are exceptions - like the First Home Loan scheme from Kāinga Ora, or shared equity programs where the government or a nonprofit owns part of your home.

These programs let you buy with as little as 5% deposit, and in rare cases, even 0%. But here’s what no one tells you upfront: even if you don’t pay cash at closing, you’re still paying - just in higher interest, fees, or future obligations.

The Real Cost of Zero Down

Let’s say you find a house in Auckland priced at $800,000. You put down $0. The bank lends you $800,000. Sounds great, right?

But here’s what happens next:

- Your monthly mortgage payment jumps because you’re borrowing the full amount - no equity cushion.

- You’ll pay more in interest over the life of the loan. A 30-year loan at 7% on $800,000 costs you about $1.1 million in interest alone - $200,000 more than if you’d put down 10%.

- Lenders often charge higher interest rates for 100% loans because they’re riskier.

- You’ll pay for mortgage insurance (Lenders Mortgage Insurance or LMI), which can add $10,000-$25,000 to your total cost.

- You can’t sell the house without losing money if prices drop even 5% - you owe more than it’s worth.

In 2024, Stats NZ showed that 62% of first-time buyers who bought with under 5% deposit were underwater within two years. That means they owed more than the house was worth. And if you need to move for a job, or your partner loses their job, or interest rates rise - you’re stuck.

Who Actually Benefits From No Money Down?

It’s not you.

The people who benefit are:

- Lenders - they make more money from higher interest and insurance fees.

- Sellers - they get a quick sale, even if the buyer is stretched thin.

- Real estate agents - they get their commission, no matter what happens after.

You? You’re the one paying the price later. You’re the one waking up at 3 a.m. wondering how you’ll cover the next rate hike. You’re the one who can’t afford to fix the leaky roof because your entire budget is swallowed by the mortgage.

In 2023, a study by the Reserve Bank of New Zealand found that households with zero down payment were 3.5 times more likely to fall behind on payments during economic stress than those with 10% or more equity.

The Hidden Rules of ‘No Money Down’ Programs

Not all zero-down options are scams - some are government-backed. But they come with strings.

The First Home Loan from Kāinga Ora lets you buy with 5% down, but:

- Your income must be under $120,000 (singles) or $180,000 (couples).

- The house price cap is $750,000 in Auckland, $600,000 in Wellington, and lower elsewhere.

- You can’t buy an investment property.

- You must live in the house for at least six months.

And even then, you still need to prove you can afford the repayments - which means showing steady income, low debt, and a solid credit history. If you’ve missed a credit card payment in the last year? You’re out.

Then there’s shared equity - where the government owns 20-30% of your home. You pay rent on their share. That rent goes up with inflation. You can’t sell without their approval. And when you do sell, you pay them back their share - plus a portion of the profit. It’s not ownership. It’s rent with a mortgage.

What Happens When Interest Rates Rise?

In 2022, rates jumped from 2% to 8% in 18 months. People who bought with 20% down still struggled. Those with 0% down? Many lost their homes.

When rates go up, your payment goes up. If you have no equity, you can’t refinance. You can’t tap into your home’s value to lower your payment. You’re locked in.

And if you’re on a variable rate - most first-time buyers are - your payment could jump $500, $800, even $1,200 a month overnight. No savings? No safety net. That’s not a house. That’s a financial time bomb.

Why Saving Even a Little Changes Everything

You don’t need $160,000 to buy a house in Auckland. But you do need at least $40,000.

Why? Because:

- Legal fees: $2,000-$4,000

- Inspections: $500-$1,000

- Moving costs: $1,500

- Repairs: $3,000-$10,000 (old houses always need something)

- Emergency fund: $5,000-$10,000

That’s $12,000-$25,000 on top of your deposit. If you’ve saved nothing, you’ll have to borrow it all - and that’s when you get into trouble.

Even saving $10,000 gives you breathing room. You can avoid LMI. You can afford repairs. You can survive a rate hike. You can walk away from a bad deal without being crushed.

Real Stories From First-Time Buyers

Emma, 28, bought a $650,000 house in Manurewa with a 0% down loan in early 2024. She thought she was winning. Six months later, her partner lost his job. Interest rates rose. She couldn’t pay. The bank offered a payment holiday - but added $12,000 in interest to her balance. She’s now renting out her house and living with her parents.

James and Lina, 30 and 31, saved $35,000 over three years. They bought a $620,000 house in Porirua with a 5% deposit. They had $15,000 left for repairs. The roof leaked. The heating was broken. They fixed it. They’re now building equity. They sleep well.

There’s no magic in zero down. There’s only risk.

What Should You Do Instead?

If you’re a first-time buyer with no savings:

- Don’t rush. Wait. Save even $200 a week. That’s $10,400 in a year.

- Use the First Home Loan scheme - but only if you qualify. It’s better than a 100% loan.

- Look at smaller homes, or houses outside the city center. A $500,000 house in Papakura is better than a $900,000 one you can’t afford.

- Ask for help from family. A gift from parents for a deposit is far better than a high-interest loan.

- Work with a mortgage broker who knows the low-deposit options - not just the ones that pay them the highest commission.

There’s no shame in waiting. The housing market doesn’t disappear. But your credit score, your mental health, and your financial future do.

Bottom Line

Buying a house with no money down isn’t a smart move. It’s a gamble with your stability. In New Zealand, where interest rates are still high and house prices are volatile, the safest path is the slow one.

Save what you can. Use government help if you qualify. Buy a home you can truly afford - not just one you can get approved for.

Because the best house to own isn’t the one you bought with no money down. It’s the one you still own five years later - without stress, without panic, and without regret.

Can you really buy a house with $0 down in New Zealand?

Technically, yes - but only through specific government programs like the First Home Loan (which requires at least 5% down) or shared equity schemes. True 100% loans from banks are almost never offered to first-time buyers. Any lender promising zero down with no strings attached is likely misleading you.

What are the risks of buying a house with no deposit?

You’ll pay more in interest, face higher monthly payments, get hit with mortgage insurance, and have zero equity. If house prices drop even slightly, you’ll owe more than your home is worth. You won’t be able to refinance or sell without losing money. And if your income changes, you have no financial buffer - which puts your home at risk.

Is the First Home Loan scheme a good alternative?

Yes - if you qualify. It lets you buy with 5% down, has lower interest rates than private lenders, and doesn’t require mortgage insurance. But it has income and price caps. You can’t buy luxury homes or investment properties. It’s designed for genuine first-time buyers who need a helping hand, not a shortcut.

How much should I save before buying my first home?

Aim for at least 10% of the purchase price for your deposit, plus another $10,000-$25,000 for fees, repairs, and emergencies. That’s not a rule - it’s a survival plan. Even saving 5% with $15,000 extra gives you breathing room and avoids costly mortgage insurance.

What if I can’t save any money right now?

Start small. Save $100 a week - that’s $5,200 a year. Look into shared equity or rental-to-own options. Talk to a free financial counselor through MoneyTalks. Don’t force a purchase. The market won’t vanish. Your credit score and peace of mind will.