Cost of Living Comparison Calculator

Your Current Expenses

Select State to Compare

Results

Why you'll save money in this state:

When you’re trying to stretch your paycheck further, where you live can make all the difference. In 2025, some states still offer dramatically lower costs for housing, groceries, utilities, and taxes than others. If you’re looking to buy a home without breaking the bank, or just want to cut your monthly expenses, knowing where the cheapest places are can save you tens of thousands of dollars a year.

Mississippi is the cheapest state to live in - here’s why

Mississippi has held the title of the cheapest state to live in for over a decade, and nothing has changed in 2025. The overall cost of living is 15% below the national average. Housing is the biggest reason. The median home price in Mississippi is $187,000 - nearly $100,000 less than the U.S. median of $285,000. You can find a 3-bedroom, 2-bath home in Jackson, Gulfport, or Tupelo for under $150,000, often with a large yard and updated features.

Utilities are also cheaper. Electricity costs about 11 cents per kilowatt-hour, compared to the national average of 16 cents. Property taxes are among the lowest in the country, averaging just $670 per year for a home valued at $150,000. Even groceries cost less - a gallon of milk runs $3.25 on average, while in California it’s over $5.50.

There’s a catch, though. Wages are lower. The median household income in Mississippi is $49,000, compared to $75,000 nationally. But if you work remotely, have a side income, or are retired, the low cost of living makes up for it. Many people who moved from Texas, Illinois, or Florida to Mississippi report saving $1,500 to $2,500 a month just by relocating.

West Virginia and Alabama close behind

West Virginia comes in second, with a cost of living 14% below the national average. Housing prices are even lower than Mississippi’s in some counties - homes in Morgantown or Huntington average $160,000. Property taxes are near zero in rural areas, and health insurance premiums are among the lowest in the country.

Alabama ranks third. The median home price is $192,000. Cities like Birmingham and Mobile have seen steady price growth, but you can still find homes under $140,000 in neighborhoods like Pratt City or Mobile’s west side. Alabama has no state income tax on Social Security, and its sales tax is capped at 4% in many counties. The state also offers a $5,000 homestead exemption for homeowners over 65, which cuts property taxes dramatically.

Both states have slower job markets, but if you don’t need to commute daily or can work online, they’re excellent for budget living. A two-bedroom apartment in Birmingham rents for $850 - less than half the cost in Atlanta or Charlotte.

What about other low-cost states?

Arkansas, Kentucky, and Missouri round out the top six. In Arkansas, homes in Little Rock or Fort Smith sell for $175,000 on average. The state has no estate or inheritance tax, and property taxes are among the lowest in the South. Kentucky offers similar savings - homes in Lexington or Owensboro are often under $200,000, and the state has a generous homestead exemption.

Missouri stands out for its mix of affordability and urban access. Kansas City and Springfield have median home prices under $200,000, and public transit is improving. The state doesn’t tax Social Security, and groceries are tax-free. Many retirees choose Missouri because of its combination of low costs and decent healthcare access.

Ohio and Indiana also deserve mention. In Cleveland and Toledo, you can buy a solid 3-bedroom home for $130,000-$160,000. Property taxes are higher than in the Deep South, but still lower than the national average. These states are ideal for people who want to live near major highways or have family ties in the Midwest.

Why housing prices are so low in these states

These states aren’t cheap because they’re underdeveloped - they’re cheap because of supply, demand, and policy. Many have seen population decline over the last 20 years, especially among younger workers moving to coastal cities. That means more homes are on the market, and fewer buyers competing for them.

Local governments also keep taxes low to attract residents. In Mississippi, the state doesn’t tax retirement income. In Alabama, property tax assessments are capped at 10% annual increases. In West Virginia, the state offers grants to help people fix up abandoned homes - you can buy a fixer-upper for $30,000 and get up to $20,000 in state funding to renovate it.

Land is abundant. In rural areas of Mississippi or Alabama, you can buy 5-10 acres for $15,000-$25,000. That’s unheard of in states like California or New York, where even a small lot can cost $100,000.

What you shouldn’t ignore about cheap states

Low cost doesn’t mean no trade-offs. Healthcare access is limited in rural areas. Many counties in Mississippi and West Virginia have only one hospital, and specialists are often hours away. Schools in these areas also tend to be underfunded - if you have kids, you’ll need to research districts carefully.

Job opportunities are fewer. While remote work has changed the game, if you need to work in person - in healthcare, manufacturing, or retail - your options are narrower. Wages for those jobs are lower, too. A nurse in Mississippi earns about 25% less than one in New York, even though the cost of living is half.

Weather and infrastructure can be challenges. Storms are more frequent in the Deep South. Power outages happen more often, especially in winter. Roads in rural areas aren’t always well-maintained. If you’re used to reliable public services, you’ll need to adjust.

Who benefits most from moving to a cheap state?

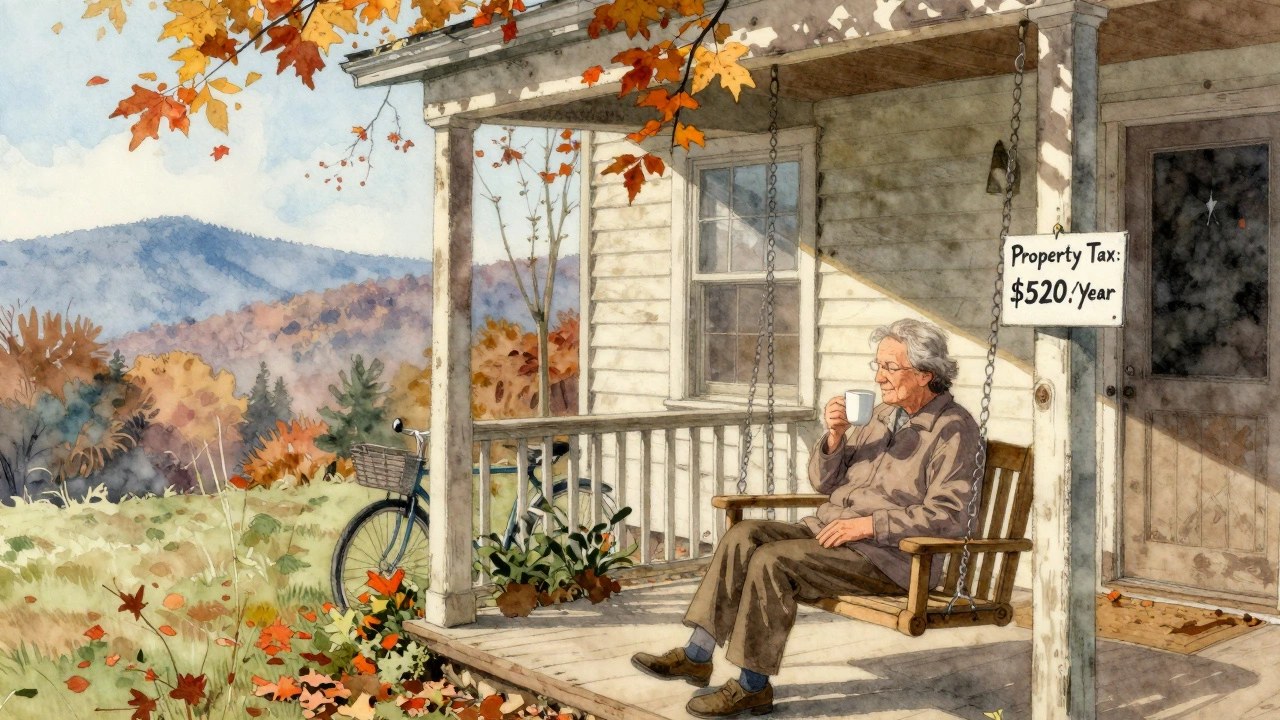

Retirees are the biggest group. Social Security and pension income go much further. A $2,000 monthly retirement check can cover a mortgage, utilities, groceries, and even a car payment in Mississippi - and still leave money for travel or hobbies.

Remote workers are next. If your job doesn’t require you to be near an office, moving to a low-cost state can cut your living expenses by 40% or more. Many digital nomads now choose Alabama or Arkansas because they can afford a larger home, a home office, and even a second car.

Young families on tight budgets also win. A couple making $60,000 a year can buy a home in Kentucky or Missouri and still save for college. In states like California or Washington, that same income barely covers rent.

Even single people benefit. Renting a one-bedroom apartment in Jackson, MS costs $700. In Chicago, it’s $1,800. That $1,100 difference can go toward paying off debt, investing, or building an emergency fund.

How to decide if a cheap state is right for you

Don’t just pick the cheapest state - pick the one that fits your life. Ask yourself:

- Do you need access to major airports or hospitals?

- Can you handle long drives for basic services?

- Are you okay with slower internet speeds in rural areas?

- Do you have family nearby, or are you willing to be far from them?

- Will your income stay the same, or will you need to find a new job?

Visit first. Spend a weekend in the town you’re considering. Talk to locals. Check the school ratings on GreatSchools.org. Look up crime stats on NeighborhoodScout. Don’t rely on blog posts or YouTube videos - real data matters.

Use a cost-of-living calculator. Sites like NerdWallet or Bankrate let you compare your current city to any other. Plug in your income, rent, and expenses. You’ll see exactly how much you’d save.

Bottom line: Cheaper doesn’t mean worse

The cheapest states to live in in 2025 aren’t the ones with the worst schools or the highest crime. They’re the ones where housing, taxes, and daily expenses are simply lower - and where people are choosing to live because they can afford to.

If you’re tired of spending half your paycheck on rent, or if you want to buy a home without a 20-year mortgage, Mississippi, West Virginia, Alabama, and other low-cost states offer real options. It’s not about giving up comfort - it’s about choosing where your money works hardest.

Many people who moved from expensive states say the same thing: they didn’t lose anything - they gained freedom. Freedom from debt. Freedom to save. Freedom to retire early. That’s worth more than a fancy neighborhood.

What state has the cheapest houses for sale in 2025?

Mississippi has the cheapest homes for sale in 2025, with a median price of $187,000. Some areas, like rural counties in the Delta region, have homes listed under $100,000. West Virginia and Alabama follow closely, with median prices around $160,000-$192,000.

Is it safe to buy a home in a cheap state?

Yes, but do your homework. Crime rates vary by city and neighborhood. For example, Jackson, MS has higher crime than Tupelo. Always check local police reports and talk to neighbors. Many homes in these states are older, so get a thorough inspection - plumbing, electrical, and roof issues are common in fixer-uppers.

Can you afford to retire in Mississippi or Alabama?

Absolutely. A $2,000 monthly Social Security check covers a mortgage, utilities, groceries, and healthcare in Mississippi. Property taxes are under $700/year, and there’s no state income tax on retirement income. Many retirees move here to stretch their savings and avoid selling their homes in expensive states.

Do cheap states have good internet and cell service?

In cities like Birmingham, Jackson, or Little Rock, internet speeds are fine - 100 Mbps is common. But in rural areas, speeds drop to 10-25 Mbps, and cell service can be spotty. If you work remotely, check providers like Starlink or T-Mobile Home Internet before moving. Many counties are upgrading infrastructure, but don’t assume high-speed internet is available everywhere.

Are property taxes really that low in these states?

Yes. In Mississippi, the average property tax on a $187,000 home is just $670 per year. In Alabama, it’s around $800. Compare that to New Jersey, where the same home would cost over $6,000 in taxes. Most of these states have homestead exemptions that reduce your taxable value by 10-50%.

What’s the best way to find cheap houses for sale in these states?

Use Zillow or Realtor.com and filter by price under $200,000. Look for foreclosures, short sales, or homes listed as "as-is." Local real estate agents in these states know about off-market deals. Join Facebook groups like "Cheap Homes in Mississippi" - many listings never hit the MLS. Be ready to move fast - good deals sell within days.