Timeshare Annual Cost Calculator

Calculate Your Annual Timeshare Costs

Estimate your total annual timeshare costs based on your specific ownership details. Remember: most owners underestimate these costs by 30-50%.

Your Estimated Annual Costs

Important: Maintenance fees typically increase 3-6% annually. Over 20 years, this can add $1,000+ to your original cost.

Warning: 68% of owners experience special assessments in 5 years. 31% pay over $1,000 in a single year.

Buying a timeshare sounds simple: pay upfront, get a vacation spot every year, and never worry about hotel prices again. But that upfront price? It’s just the beginning. The real cost of a timeshare shows up every single year - and it’s often higher than most people expect.

What You Actually Pay Each Year

The average annual cost of owning a timeshare in the U.S. is between $1,000 and $2,500. That’s not one fee - it’s a mix of charges bundled together. Most owners don’t realize they’re paying for five different things:

- Maintenance fees: This covers cleaning, repairs, pool upkeep, landscaping, and staff wages. For a standard 1-bedroom unit at a mid-range resort, expect $700-$1,200 a year.

- Property taxes: Even though you don’t own the land outright, you still pay a share of the property tax. This varies by location - Florida and Nevada run higher, while places like the Ozarks are lower. Typically $100-$400 per year.

- Special assessments: These are surprise fees for big repairs - think new roofs, elevator upgrades, or pool resurfacing. They can hit you for $200-$1,500 in a single year. No warning. No vote. Just a bill.

- Exchange fees: If you want to trade your week for a different resort or season, you’ll pay $90-$200 per exchange through companies like RCI or Interval International.

- Membership or administrative fees: Some resorts charge a flat annual fee just to stay in their system. This can be $50-$150 extra.

Put it all together, and even a "basic" timeshare can easily cost $1,500-$2,200 per year. That’s more than many people pay for a decent Airbnb or hotel stay every single year - and you’re locked in for decades.

Why the Numbers Are Higher Than You Think

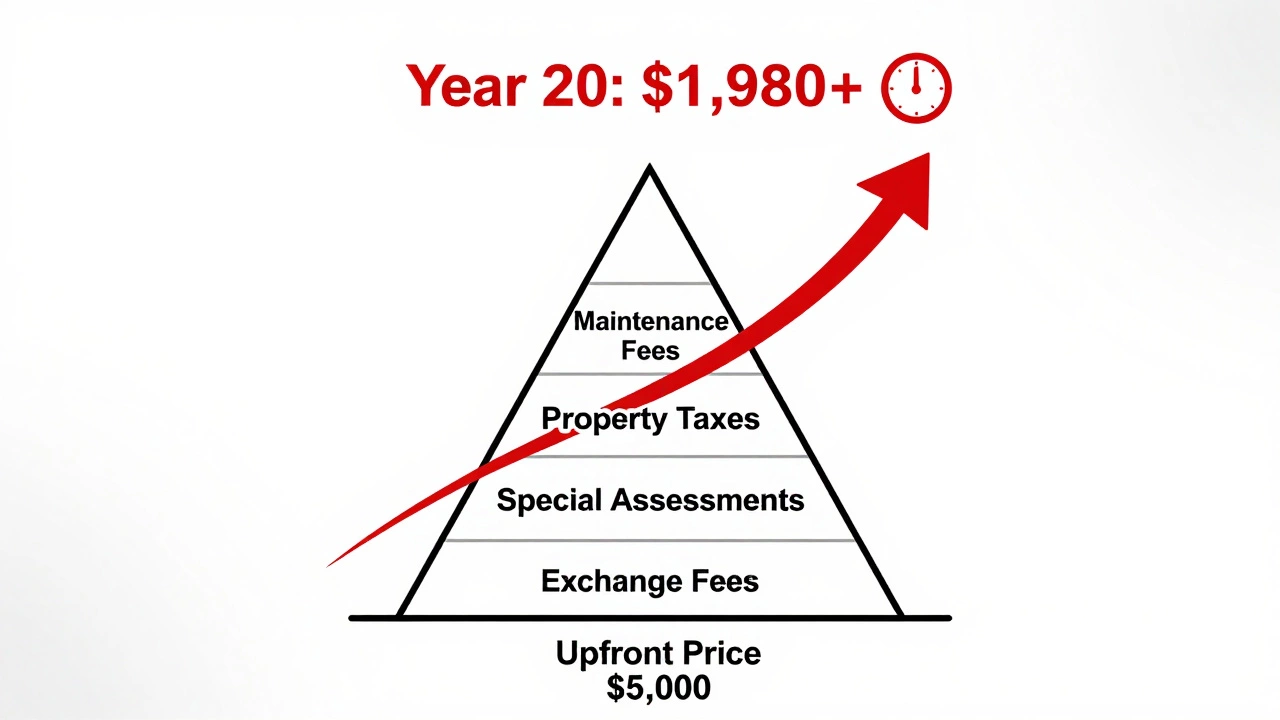

Timeshare companies advertise low upfront prices - sometimes as little as $5,000. But they rarely mention that maintenance fees rise 3% to 6% every year, on average. Over 20 years, that compounds hard.

Take a $900 annual fee in year one. With a 4% annual increase:

- Year 5: $1,090

- Year 10: $1,330

- Year 20: $1,980

That’s over $1,000 more than you paid in year one - just from inflation. And that’s before any special assessments. A 2023 study by the American Resort Development Association found that 68% of timeshare owners experienced at least one special assessment in the past five years, with 31% paying over $1,000 in a single year.

Also, many timeshares are sold as "points" instead of weeks. That sounds flexible - until you realize points lose value. A 7,000-point package might get you a week in Florida today, but next year, it might only cover a long weekend. Resorts change point values based on demand, and you have zero control over it.

Timeshare vs. Alternatives: What’s Really Cheaper?

Let’s compare a typical timeshare to other ways to vacation.

| Option | Average Annual Cost | Flexibility | Resale Value |

|---|---|---|---|

| Timeshare | $1,500-$2,500 | Low - locked to specific week/resort | Negative - often sells for 10-20% of original price |

| Hotel stays (4x/year) | $1,200-$2,000 | High - choose any destination | N/A - no ownership |

| Airbnb (4x/year) | $1,500-$2,800 | High - full control | N/A |

| Vacation club (points-based) | $1,800-$3,000 | Medium - depends on point availability | Very low - rarely resold |

Notice something? You can get similar or better flexibility with hotels or Airbnb for less - and without the long-term contract. Plus, you’re not stuck with a property you don’t like anymore. Timeshares are designed to be hard to exit. Resale markets are flooded. Most owners sell for pennies on the dollar, if they sell at all.

The Hidden Trap: Long-Term Commitments

Timeshare contracts are usually for 20 to 99 years. That’s longer than most mortgages. And if you try to walk away, you’re on the hook for fees until the contract ends - or you pay thousands to get out.

Companies like Marriott, Hilton, and Hyatt have bought up timeshare brands and now use aggressive tactics to keep owners locked in. They offer "free" upgrades or "exclusive" perks if you renew. But those perks cost more in fees. Many people feel trapped because they’ve already paid upfront and don’t want to lose that investment.

There’s no legal way to cancel a timeshare contract early in most states. Even if you stop paying, the resort can send your debt to collections, hit your credit score, or even sue you. In 2024, over 12,000 timeshare owners in the U.S. were taken to court over unpaid fees - and most didn’t even use their week that year.

Who Should Avoid a Timeshare?

Timeshares make sense for maybe 1 in 10 people. Here’s who should stay away:

- You travel less than twice a year - you’ll never use it enough to justify the cost.

- You like changing destinations - you’ll hate being locked into one place.

- You’re on a fixed income - those annual fees will keep rising.

- You’ve never read the fine print - you don’t know what you’re signing up for.

- You’re buying because someone you trust told you to - don’t let emotion override logic.

If you’re thinking about buying a timeshare, ask yourself: "Would I pay this much every year for a vacation I can’t change?" If the answer isn’t a clear yes, walk away.

What to Do If You Already Own One

If you’re already stuck, here’s what actually works:

- Stop paying? No. That hurts your credit and invites lawsuits.

- Try to sell it? Maybe. Use sites like RedWeek or Timeshare Users Group. Be ready to accept 5-15% of what you paid.

- Donate it? Some nonprofits take timeshares, but you won’t get a tax break unless the resort is nonprofit - and even then, you’re still responsible for fees until the transfer clears.

- Use a timeshare exit company? Be extremely careful. Many are scams. Only work with firms registered with the Better Business Bureau and that don’t charge upfront fees.

- Just keep paying? Only if you love the place and can afford the rising costs.

There’s no magic fix. The best move is to avoid getting in. But if you’re already in, treat it like a car payment you can’t trade in - just keep paying or find a way out without getting scammed.

Final Thought: It’s Not a Vacation - It’s a Liability

A timeshare isn’t an asset. It’s a liability that grows every year. Unlike a home, it doesn’t appreciate. Unlike a rental, it doesn’t earn money. It’s a vacation you pay for - and then pay again - and again - for decades.

Most people buy timeshares because they’re sold on the dream: "Your own beach house every year!" But the reality? You’re paying for a fixed week in a place you might not even want anymore, while fees climb, options shrink, and your freedom vanishes.

If you want a great vacation every year, save up. Book hotels. Rent an Airbnb. Travel off-season. You’ll save money, have more choices, and never get stuck with a bill you can’t escape.

Is the annual cost of a timeshare tax-deductible?

No. Timeshare maintenance fees, property taxes, and exchange fees are not tax-deductible unless you rent out your week and report the income. Even then, you can only deduct expenses directly tied to rental use - not personal use. The IRS treats timeshares as personal property, not investment property.

Can I get out of a timeshare contract?

It’s possible, but hard. Most states give you a 5- to 10-day rescission period after signing - if you cancel within that window, you get your money back. After that, you’re locked in. Your only real options are selling it (often at a loss), donating it (rarely useful), or using a licensed exit company that doesn’t charge upfront fees. Avoid companies that promise to cancel your contract for $5,000 - they’re almost always scams.

What happens if I stop paying my timeshare fees?

The resort will send your account to collections. Your credit score will drop by 100+ points. You may get sued, and in some states, they can place a lien on your other property. Even if you stop using the timeshare, you’re still legally responsible for all fees until the contract ends - which could be 30, 50, or even 99 years.

Are all timeshares the same in cost?

No. Costs vary wildly by location, brand, and unit size. A small studio in a rural resort might cost $600/year. A luxury 2-bedroom in Orlando or Hawaii can hit $4,000/year. Points-based systems are harder to predict - their value changes based on demand, so what costs $1,200 this year might cost $1,800 next year for the same "package." Always ask for a detailed breakdown of all fees before signing.

Do timeshares include travel insurance or airfare?

Never. Timeshare salespeople sometimes imply you’re getting a "deal" that includes flights or insurance, but that’s misleading. The price you pay covers only the accommodation and resort fees. You pay for airfare, rental cars, meals, and insurance yourself. If someone says otherwise, they’re misrepresenting the product.