Auckland Home Affordability Calculator

How Much House Can You Afford?

Based on New Zealand's current lending standards and realistic budgeting for Auckland residents.

Your Results

- Includes $10,000-$15,000 for closing costs (legal fees, inspections, moving)

- Based on a 30-year term with current interest rates

- 10% deposit required for first home buyers

- Remember to factor in property rates ($2,500-$4,000/year)

If you make $100,000 a year in Auckland and are thinking about buying your first home, you’re not alone. Thousands of first-time buyers are asking the same question: how much house can I actually afford? The answer isn’t just about your salary-it’s about debt, interest rates, living costs, and what banks are willing to lend right now.

What Banks Will Lend You

In New Zealand, banks use a loan-to-income (LTI) limit to decide how much you can borrow. As of late 2025, most lenders cap loans at 5.5 times your gross annual income. That means if you earn $100,000, the maximum you can borrow is $550,000.

But here’s the catch: that’s the maximum they’ll allow-not what you should spend. Banks don’t factor in your rent, groceries, childcare, or car payments. They only check your income, existing debts, and living expenses using their internal assessment tools. Just because you can borrow $550,000 doesn’t mean you should.

Realistic Budget: What You Can Actually Pay

Let’s break it down with real numbers. After tax, a $100,000 salary in New Zealand leaves you with about $72,000 a year, or $6,000 a month. Now subtract:

- $1,200 for rent (if you’re still renting)

- $800 for groceries and household supplies

- $400 for transport (car, petrol, public transit)

- $300 for phone, internet, streaming

- $500 for savings, insurance, and emergencies

- $600 for lifestyle (eating out, hobbies, gifts)

That leaves you with roughly $2,200 a month to put toward a mortgage. At today’s average interest rate of 7.2% (as of November 2025), a $2,200 monthly payment gets you a loan of about $320,000 over 30 years.

That means, realistically, you’re looking at homes priced around $380,000 to $400,000-assuming you’ve saved a 10% deposit of $38,000 to $40,000. Most lenders require at least 10% down for first-time buyers, and many are stricter if you’re not using a KiwiSaver first-home withdrawal.

Deposit Matters More Than You Think

Let’s say you’ve saved $60,000. That’s excellent. Now you can afford a $400,000 home with a 15% deposit. But if you’ve only saved $20,000, you’re looking at a $200,000 property. That’s not a starter home-it’s a tiny studio in a suburb with no schools, no public transport, and a 45-minute commute.

The deposit isn’t just a number. It’s your freedom. The more you put down, the lower your monthly payments, the less interest you pay over time, and the more likely you are to get approved. Many first-time buyers think they need to wait until they have 20%, but in Auckland, even 10% can get you in the door-if you’re smart about location and property type.

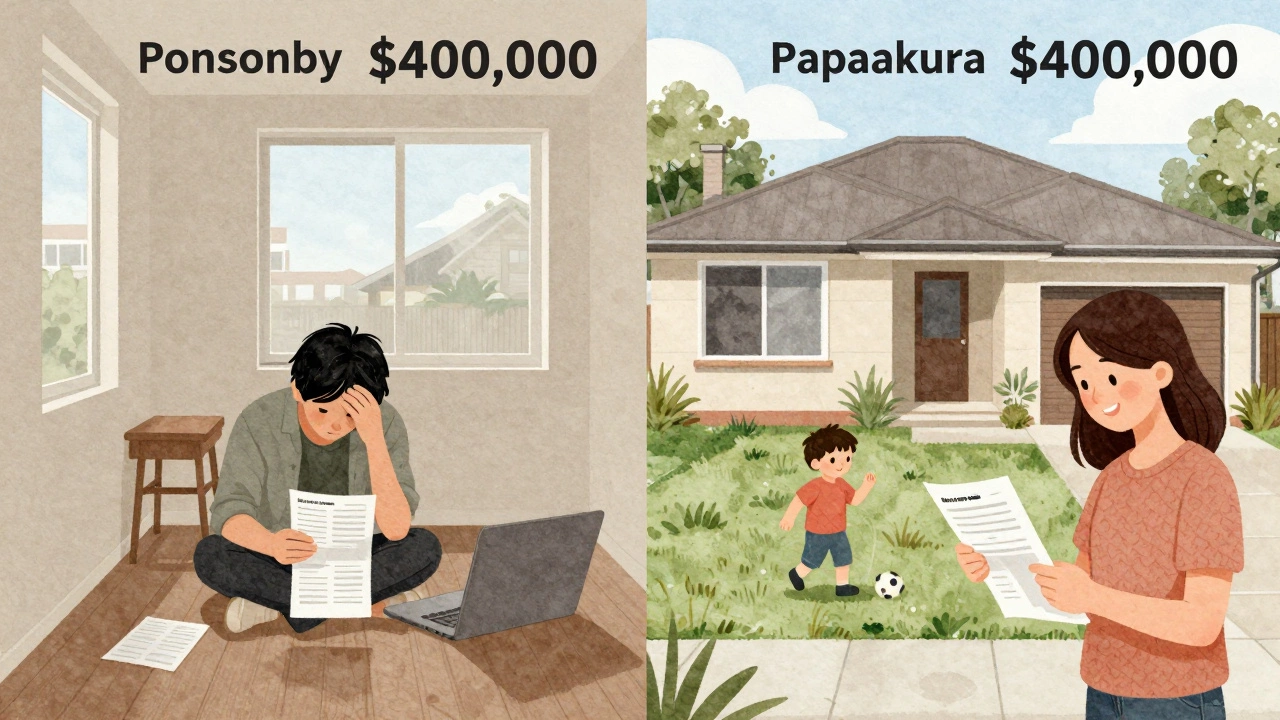

Location Changes Everything

A $400,000 home in Ponsonby is a one-bedroom apartment. In Manukau, it’s a three-bedroom house with a backyard. In Papakura, you might get a newer build with a garage. The same budget buys you completely different lifestyles.

First-time buyers who stretch for the city center often end up house-poor-spending 60% of their income on housing, with nothing left for emergencies, travel, or starting a family. Buyers who look 15-20 minutes outside the CBD find better value and more space. Places like Manurewa, Glen Innes, or even Pukekohe offer homes under $400,000 with good schools and bus routes.

Don’t fall for the myth that you need to be in the inner city to be successful. Your commute time and weekly fuel costs add up. A $50,000 cheaper home that’s 20 minutes further out might save you $15,000 a year in transport and stress.

What About KiwiSaver?

If you’ve been contributing to KiwiSaver for at least three years, you can use your savings as part of your deposit. Most first-time buyers get a $5,000 to $10,000 government contribution (HomeStart grant) on top of that.

That $10,000 can mean the difference between getting into a $380,000 home or being stuck at $350,000. You can also use your KiwiSaver to pay off part of your mortgage after settlement. Check with your provider-some let you withdraw funds within 90 days of buying.

Hidden Costs You Can’t Ignore

Most first-time buyers forget about the extras:

- Legal fees: $1,500-$2,500

- Building inspection: $500-$800

- Valuation fee: $300-$500

- Moving costs: $800-$2,000

- Home insurance: $1,000-$1,800/year

- Property rates: $2,500-$4,000/year (varies by council)

- Repairs and maintenance: $1,500-$3,000/year

That’s another $10,000-$15,000 you need to have ready before you sign anything. If you’ve spent every dollar on your deposit, you’ll be stuck paying for a leaky roof out of pocket.

What You Should Do Next

Here’s a simple action plan:

- Check your credit score. Aim for 700+.

- Use a free mortgage calculator from the Reserve Bank of New Zealand or Consumer NZ to test different scenarios.

- Save at least 10% of the home price-not just for the deposit, but for closing costs too.

- Get pre-approved for a loan. It shows sellers you’re serious and helps you lock in your budget.

- Visit open homes in suburbs outside the inner city. Don’t limit yourself to what you think you “deserve.”

- Talk to a financial adviser who specializes in first-home buyers. Many offer free 30-minute sessions.

Can You Buy a House on $100k in Auckland?

Yes-but not the house you imagine. You won’t get a three-bedroom villa in Remuera. But you can buy a solid, modern, low-maintenance home in a growing suburb with good schools, public transport, and room to grow. The key isn’t earning more-it’s spending smarter.

Many people who bought on $100k in 2023 are now sitting on $600,000 homes because they bought early, stayed put, and didn’t chase the dream house. They focused on stability, not status.

Your house doesn’t have to be perfect. It just has to be yours.

Can I buy a house on $100k a year in Auckland?

Yes, but you’ll need a 10% deposit and to look outside the inner city. With a $100k salary, you can realistically afford a home between $380,000 and $420,000 after factoring in mortgage payments, living costs, and closing expenses. Banks may approve you for up to $550,000, but that’s not affordable without financial strain.

How much deposit do I need for a $400k house?

You need at least $40,000 for a 10% deposit. But you should also have $10,000-$15,000 saved for legal fees, inspections, moving costs, and insurance. That means you’ll need $50,000-$55,000 total before you can buy. KiwiSaver can help cover part of this.

Is it better to rent or buy on a $100k salary?

If you plan to stay in Auckland for five years or more, buying is almost always better. Renting $2,500/month means you’re paying $30,000 a year with nothing to show for it. Buying a $400,000 home with a $40,000 deposit and $2,200/month mortgage means you’re building equity. Even with rising interest rates, ownership wins over time.

What’s the average house price in Auckland right now?

As of November 2025, the average house price in Auckland is around $850,000. But that number is skewed by luxury homes. The median price-what half of homes sell for-is $720,000. For first-time buyers, the sweet spot is $350,000-$450,000, where you’ll find more realistic options.

Can I use my KiwiSaver to buy a house?

Yes-if you’ve been contributing for at least three years, you can withdraw your contributions, employer contributions, and investment returns for your first home. You may also qualify for a HomeStart grant of up to $10,000 (single) or $20,000 (couple) if your income is under $120,000. Check with your KiwiSaver provider and Housing New Zealand for eligibility.

Should I wait for interest rates to drop before buying?

Waiting for lower rates is risky. Interest rates might drop next year-or they might stay high for another three years. Housing prices don’t wait. If you’re ready to buy now, lock in your budget, get pre-approved, and start looking. The goal isn’t to time the market-it’s to get into a home you can live in and afford long-term.